ONG Rebate Form – Have you ever wondered about that elusive ONG Rebate Form that people talk about when saving some extra bucks? Well, you’re in the right place to unravel the mystery. Rebate forms are more than just paperwork; they’re your ticket to pocket-friendly energy solutions. Let’s dive in!

What is an ONG Rebate Form?

An ONG Rebate Form is a document that allows you to claim rebates on your energy bills. ONG, or Oklahoma Natural Gas, offers various rebates to help you make energy-efficient choices.

Importance of ONG Rebate Forms

Rebate forms can offer you substantial savings. They encourage you to make energy-efficient choices, thereby not only saving you money but also helping the environment. Cool, right?

How Do ONG Rebate Forms Work?

Are you curious about the specific requirements or the various types of rebates that are available? Allow me to explain everything in detail so you can have a clear understanding.

Eligibility Criteria

Generally, you’ll need to be an ONG customer with an active account. Other criteria might include purchasing certain energy-efficient appliances or undertaking home improvement projects.

Types of Rebates

Discover the multitude of rebates available for a range of energy-efficient solutions, from water heaters to insulation. Take advantage of these incentives to save money while promoting a greener and more sustainable future for your home or business. Don’t miss out on the opportunity to receive financial assistance for your eco-friendly upgrades. Apply now and reap the benefits!

Steps to Fill Out an ONG Rebate Form

Completing forms may sometimes feel daunting, but don’t worry! We’re here to simplify the process and make it as effortless as enjoying a slice of pie. So, hang in there and let us guide you through each step with ease.

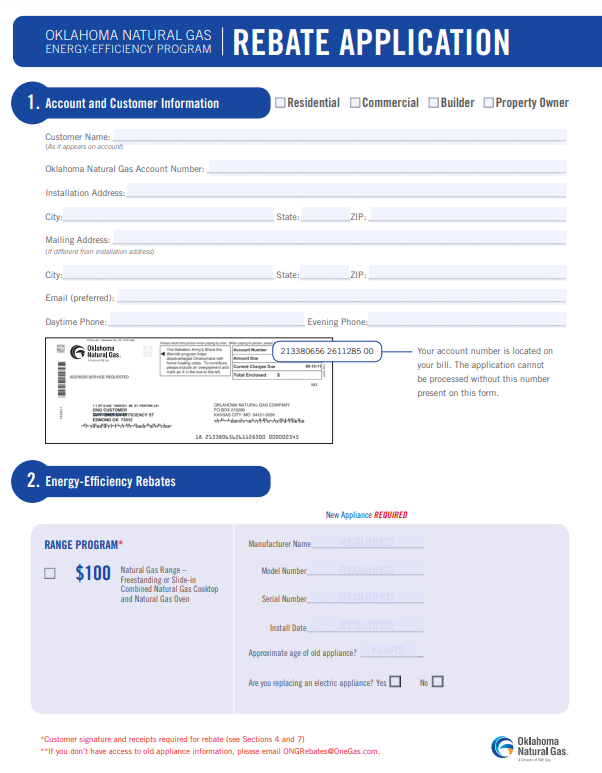

Collect Necessary Documents

To get started, it’s important to gather all the essential paperwork. This includes gathering purchase receipts and your most up-to-date energy bill. By having these documents on hand, you’ll be well-prepared and ensure a smooth process moving forward.

Complete the Form

Take your time and ensure that you fill out the form with meticulous attention to detail. The last thing you want is for a simple error to cause you to miss out on valuable savings. Give it your utmost care and accuracy to make sure everything is correct and secure those well-deserved discounts.

Double-Check for Accuracy

Before finalizing anything, it’s always a good idea to double-check all the details. Trust me, taking the time to be cautious will pay off in the long run. Being thorough and careful ensures that everything is accurate and avoids any potential mistakes or oversights.

Online vs Paper Submission

The age-old dilemma: should you stick with traditional paper or embrace the convenience of digital? Let me present a compelling case for both options.

Pros and Cons

While online documents offer the convenience of speed, there’s something undeniably reassuring about having physical paper copies in hand. It ultimately boils down to personal preference and what works best for you. So, whether you prefer the efficiency of digital files or the comfort and tangible feel of printed documents, choose the option that aligns with your needs and gives you peace of mind.

Steps for Online Submission

Experience the ultimate convenience by simply logging in, uploading your documents, and effortlessly submitting them. Voila! Your task is completed with utmost ease.

Steps for Paper Submission

For those who prefer traditional methods, you have the option to mail your concluded form along with all required records to the specified address. This allows you to adhere to a more familiar process while still meeting all requirements efficiently and effectively.

Tax Implications

Indeed, it’s important to be aware that even rebates, seemingly harmless monetary incentives offered by companies, can have significant tax implications. While they may appear as simple discounts or refunds on purchases, the IRS treats them as taxable income in certain situations. By staying informed and accurately reporting these transactions, you can ensure compliance with tax regulations while making the most of your financial resources.

Is the Rebate Taxable?

When it comes to utility rebates, they are typically not subject to tax. However, it is always recommended to consult with a knowledgeable tax advisor to ensure compliance with any specific regulations or circumstances that may apply.

Necessary Documentation for Tax Purposes

It is always advisable to maintain a diligent habit of keeping your forms and receipts, as it serves as a proactive measure to ensure your peace of mind. By doing so, you are embracing the principle of “better safe than sorry,” safeguarding yourself against any unforeseen circumstances or potential disputes that may arise in the future. Maintaining such records not only demonstrates your organizational skills but also provides you with tangible evidence and protection should the need for verification or proof arise. So, remember, it is in your best interest to preserve these essential documents to protect both your personal interests and overall well-being.

ONG Rebate Form for Businesses

Businesses stand to gain significant advantages by leveraging AI technology. The impact can be truly transformative, leading to substantial growth and success. With the ability to automate tasks, streamline operations, and make data-driven decisions, businesses can save valuable resources while enhancing productivity and efficiency. Embracing AI is an opportunity for businesses to thrive in a rapidly evolving marketplace and stay ahead of the competition.

Special Requirements

In the world of business, it is common for companies to have distinct needs and demands that individuals simply cannot fulfill. This is where the expertise and capabilities of businesses come into play, offering tailored solutions that cater specifically to these unique requirements. By understanding and addressing these specific challenges, businesses are able to provide specialized services that exceed what individuals can offer.

Advantages for Businesses

Unlock substantial savings on overhead costs with these irresistible rebates. By taking advantage of these offers, businesses can enjoy significant financial benefits that ultimately contribute to their bottom line. Don’t miss out on the opportunity to optimize your expenses and increase profitability with these cost-saving rebates.

Conclusion

Congratulations! You have just completed a successful project. Now, let’s take a moment to explore the amazing benefits of ONG Rebate Forms. These forms not only help you save money but also promote energy efficiency, which is crucial in today’s world. Don’t be intimidated by the process; it is actually much simpler than you might imagine. By taking advantage of these rebate forms, you can make significant savings while contributing towards a greener future for our planet. So why wait? Start filling out your ONG Rebate Forms today and take a step towards a more sustainable and cost-effective lifestyle!