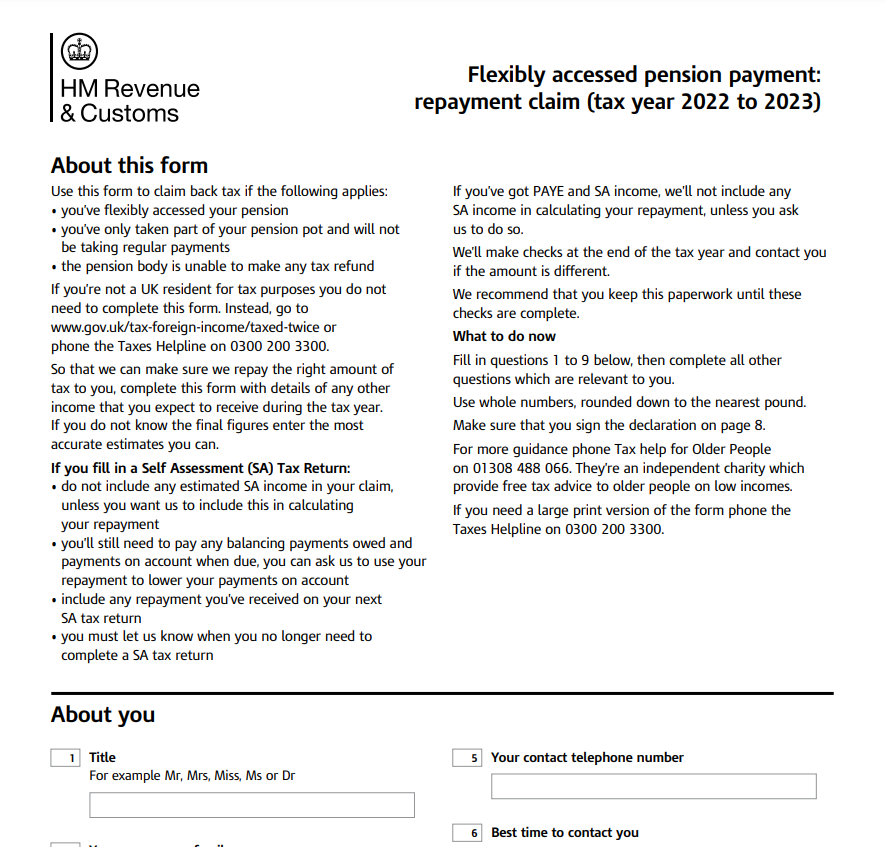

P55 Tax Rebate Form – When completing a P55 Tax Rebate Form, there are a number of crucial considerations that must be made. These include the specifics of what needs to be disclosed and the deadlines for requesting refunds of overpaid pension withdrawal taxes. Do not hesitate to contact me if you have any questions.

completing a P55 claim form for a tax rebate

After the tax year has ended, a P55 tax rebate claim form must be submitted within 30 days. Personal information must be included into the form. Your National Insurance Number and Pay-As-You-Earn Number are included in this. Additionally, it will need your contact information and the best time to reach you. Your information must be correct, and you must include information that was omitted from the prior tax return. Your employment income, including any taxable benefits you get, is described in the form’s remaining sections.

The form can be downloaded, filled out online, and sent to HMRC. To access the online form, enter your Government Gateway login information. You need to be signed up for this service in order to use the form. You can open a Government Gateway account if you don’t already have one. If you want to claim the tax you paid but don’t have any income or benefits, you can also use the P50Z form.

Details needed to fill out the form

You can submit the P55 Tax Rebate Form to get a reimbursement if you have overpaid taxes. Within 30 days of the end of the tax year, the form must be filed. It is crucial to remember that before submitting the form, you must have the correct data. Your personal information, National Insurance number, and Pay-As-You-Earn number are all included in this data. Your employer is the best source for this information.

Pensioners can speed up the tax repayment procedure by completing the P55 Tax Rebate Form. If a pensioner does not get state compensation or a P45, they must utilize this form rather than the P45. Any additional income that the pensioner receives should also be disclosed on the P55 Tax Rebate Form. Additionally, a P53Z form is utilized when a pensioner receives income.

Any pension withdrawal is tax-free for the first 25%. Anything above that, however, is subject to an emergency tax. Compared to the ordinary tax rate, this tax is significantly greater. If you believe that you overpaid this tax, you may be able to get a refund. A P55 form must be submitted by the end of the tax term and can be printed out or filled out online.

Time limit for requesting a reimbursement of overpayment pension withdrawal taxes

In the previous three months, HM Revenue & Customs (HMRC) has reported that it had repaid PS54 million to overpaid pensioners. The dates in these numbers range from July 1 through September 30, 2019. Since the introduction of pension freedoms, this return amount is the largest. HMRC handled 5,253 P53Z forms for modest pension lump amounts and 10,379 P55 forms for flexibly accessed pension overpayments during this time. Furthermore, 1,753 P50Z applications were processed.

Most of the time, people who get overpayments have already paid or withheld federal income taxes on them. When making repayments, a lot of these people inquire about the possibility of obtaining a tax refund for overpayments. However, it’s crucial to keep in mind that the person who got the overpayment must make a claim for any tax refund. It’s also vital to remember that sponsors and administrators of plans are not permitted to give tax advice. The overall tax ramifications of overpayment recoupments should be explained, nevertheless.

You need to have the necessary documentation to establish your income in order to make a refund claim. You must call the HMRC helpdesk if you don’t have the required documentation. The deadline for filing a claim is five years after the end of your tax year.

Download P55 Tax Rebate Form 2024