PA Tax Rebate Forms – Hey, you made it here, which means you’re looking to understand the intricate world of PA Tax Rebate Forms. I get it; taxes can be as confusing as assembling furniture without an instruction manual. But don’t worry, we’ll navigate through this together, step by step.

What Are PA Tax Rebate Forms?

In the realm of Pennsylvania taxes, two key forms play pivotal roles:

Property Tax/Rent Rebate

Designed with the well-being of senior citizens, widows, widowers, and individuals with disabilities in mind, this exclusive form aims to provide much-needed financial relief. By offering a generous rebate on property taxes or rent paid in the previous year, we strive to ease any financial burdens and empower our valued community members to thrive.

Tax Forgiveness Forms

Discover the convenience of the “PA Schedule SP” forms, designed specifically to help eligible taxpayers minimize or even eliminate their Pennsylvania income tax obligations. Empowering individuals with a valuable tool to navigate their tax liabilities, these forms pave the way for significant savings and financial relief. Take advantage of this opportunity to optimize your tax situation and enjoy more financial freedom.

Why Do You Need Them?

Consider these forms your golden tickets to some extra dollars in your pocket! Filling them out correctly could mean you’re eligible for a rebate or even full tax forgiveness. Who doesn’t love a financial break?

Who Is Eligible for PA Tax Rebates?

Let’s break it down:

Criteria for Property Tax/Rent Rebate

- Age 65 or older

- Widows and widowers aged 50 and older

- People with disabilities aged 18 and older

Criteria for Tax Forgiveness

- Income within certain thresholds

- Fulfill specific Pennsylvania residency requirements

How to Get the PA Tax Rebate Forms

Online Access

Save yourself the hassle of searching far and wide for these forms! Simply head over to the official Pennsylvania Department of Revenue website, where you’ll find a convenient download section ready for your use. Get your hands on these forms quickly and effortlessly, all in one trusted location.

Physical Locations

You’ll be glad to know that you can easily access these forms not only at public libraries but also at Department of Revenue offices and district offices. These locations are specifically designed to provide these forms to the public, ensuring that you have convenient and reliable access when you need them.

How to Fill Out the Forms

Required Documents

To ensure a smooth process, it is important to have certain documents ready. These include proof of income, residency, and, in some cases, medical documentation for specific disabilities. By having these documents prepared and readily available, you can expedite the necessary procedures and ensure everything is in order.

Common Mistakes to Avoid

It is important to exert caution when operating with numbers and ensure that you furnish precise information. By doing so, you can prevent any potential delays or rejections that may arise. Attention to detail in numerical data is a crucial practice that can help streamline your processes and ensure smooth operations.

Submission Process

To ensure a smooth process, simply follow the form instructions and send your completed forms to the designated address. Don’t hesitate to reach out if you have any questions or need further assistance.

Online

Submitting forms online through secure portals offers an added layer of convenience and security. By employing this process, you can confirm that your personal details remains protected while streamlining the submission process. State goodbye to the annoyance of printing, scanning, and mailing forms – with online submissions, it’s as easy as a few clicks.

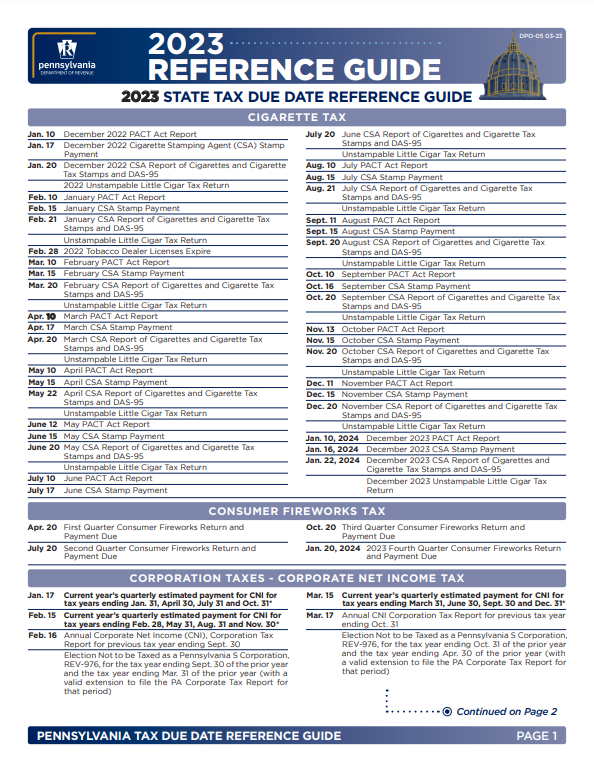

Deadlines and Important Dates

Don’t forget to mark your calendars! The deadlines for property tax and rent rebates are typically around June 30th, giving you ample time to gather the necessary documents and submit your claim. And for income tax filings, make sure to have everything in order by April 15th – a date that’s etched in every taxpayer’s mind. Meeting these deadlines ensures a smooth process and saves you from any unnecessary stress.

FAQs and Resources

With an extensive FAQ section on their official website, you’ll find answers to most of your questions. However, if you still need assistance, their dedicated helpline is readily available to provide personalized support. Don’t hesitate to reach out for prompt and helpful guidance.

Common Troubles and Solutions

Rejection Reasons

One common issue that often arises is when important documents are missing, or there is incomplete information. These situations can cause delays and inefficiencies in the workflow, leading to frustration and potentially costly errors.

Appeals

Rest assured that if you strongly believe your rebate was unfairly denied, you have every right to appeal the decision. Your satisfaction is our priority, and we are dedicated to providing that you accept the usefulness you are entitled to. Don’t hesitate to exercise your right, and let us rectify any misunderstandings or errors in a fair and timely manner.

Benefits of Properly Utilizing PA Tax Rebate Forms

Ensuring accurate completion of these forms can greatly benefit you financially and demonstrate your commitment to being a responsible member of society. By providing the correct information, you increase your chances of receiving financial assistance and enhance your reputation as a conscientious individual.

Conclusion

Understanding PA Tax Rebate Forms doesn’t have to be like solving a Rubik’s Cube. By following the steps and guidelines we’ve outlined, you’ll find that what seemed daunting is actually manageable.