PPI Tax Rebate Form – You might be asking whether the interest component of a PPI tax refund is taxable. Fortunately, there isn’t much of a challenge in answering this. If a PPI tax refund includes an interest component rather than a return of premiums, the interest component is taxable.

A PPI refund’s interest component is taxed.

Depending on your income tax rate, you may or may not be able to deduct the interest component of a PPI refund. 8% of the refund may be deductible, but any deductions in excess of this will put you in a higher tax rate. A tax expert can assist you in determining your tax obligation depending on your particular situation.

A PPI refund’s interest component is also a taxable benefit. You must include it in your self-assessment tax return and report it to HMRC. You are not required to pay tax on the interest, though, if you do not have the earnings or assets enough to claim it. However, you must be sure that you are familiar with the guidelines for how to treat interest on your tax return.

If you have filed a PPI claim, you may subtract both the original premium and the interest component. The interest component, if taxable, must be paid if you have already paid for this insurance. Before the return reaches you, the majority of businesses deduct the standard 20%.

For the current tax year as well as the previous four tax years, you may deduct PPI tax up to PS1,000 in interest. However, you might have to pay tax on the interest component if the interest collected on your PPI payments falls below your personal savings allowance. Fortunately, the majority of people do not make more money than their annual personal savings allotment.

PPI premium refunds are not taxed.

PPI premiums that have already been paid for may be refunded. If you submitted a self-assessment tax return, you may do this. The remainder of the refund is not taxed, but the statutory interest is.

20% will often be subtracted from PPI payouts. The goal here is to put the customer’s finances back where they were before the PPI transaction. Even if the funds were used to cover debts or legal costs, this deduction still applies. The typical compensation is 1,700 PS. PS175k was the largest settlement.

If you paid your PPI premiums over four years, you may be eligible for a refund. You might be eligible to receive your entire return back, depending on the magnitude of the refund. On top of that, you can claim interest on the return. In 2019/20, the tax threshold for PPI refunds is PS18,500. This is equivalent to the PS500 tax-free savings allowance for basic rate taxpayers as well as your personal allowance of PS12,500 for the year. People with modest incomes can also receive this payment.

Due to the PPI scam, the bank was compelled to return PS38 billion to more than 12 million consumers. Although the deadline for premium refunds had passed, thousands of requests were still unresolved. In August 2019, the story was supposed to be over, but the current revelation of unethical commission payments has started a new one.

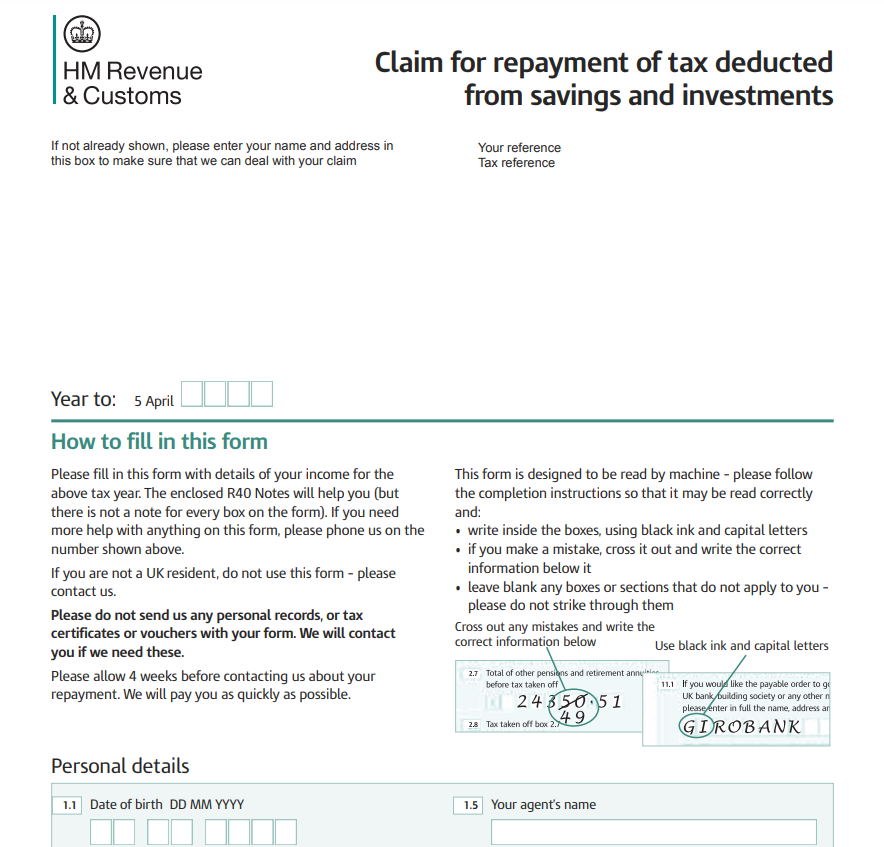

Download PPI Tax Rebate Form 2024