Rebate Under New Tax Regime – understanding the intricacies of taxation is paramount to managing your finances wisely. With the ever-evolving tax policies, it’s crucial to keep up with the latest changes and explore opportunities that can help you save more. This article dives into the concept of rebates under the new tax regime, shedding light on the types of rebates available, eligibility criteria, and how they impact your tax savings.

Types of Rebates

Rebate on HRA

One of the most common rebates individuals can claim is the House Rent Allowance (HRA) rebate. If you’re a salaried individual staying in a rented house, you can claim this rebate. The amount you can claim depends on your rent expenses, making it a great way to reduce your tax liability.

Rebate on Home Loan Interest

Owning a home is a dream for many, and the government provides incentives in the form of a rebate on the interest paid on your home loan. This rebate can significantly lower your tax burden and make homeownership more affordable.

Rebate on Education Loan Interest

Investing in education is essential, and the government acknowledges this by offering rebates on the interest paid for education loans. This not only encourages higher education but also reduces the financial burden on individuals and parents.

Eligibility Criteria

Who can claim rebates?

To claim these rebates, you need to meet specific criteria. For HRA rebate, you must be a salaried individual living in a rented house. The eligibility for the home loan interest and education loan interest rebates varies, but typically they are available to anyone who meets specific income and loan-related criteria.

Conditions for claiming rebates

Apart from meeting the eligibility criteria, there are certain conditions you must adhere to, such as providing rent receipts for HRA rebate and ensuring that your home loan is taken for a self-occupied property. Understanding and fulfilling these conditions is vital for successful rebate claims.

Filing for Rebates

Steps to file for rebates

To claim these rebates, you need to file your taxes correctly. Make sure to include the relevant sections while filing your tax returns. For HRA, provide rent receipts and salary details, and for home and education loan rebates, submit the necessary documents along with your tax return.

Documents required

Keep your documents in order, including rent receipts, loan interest certificates, and other supporting documents for your claims. Missing or incorrect documentation can lead to claim rejection.

Common Mistakes to Avoid

Errors while filing for rebates

Filing for rebates can be complex, and common mistakes include providing incorrect information, not following the required procedures, or miscalculating the amount you can claim. Ensure accuracy to prevent complications.

Consequences of incorrect claims

Incorrect rebate claims can result in penalties, tax notices, and unnecessary stress. It’s essential to avoid these mistakes to maintain a clean financial record.

Impact on Tax Savings

How rebates affect your taxes

Rebates directly impact your tax liability. By correctly claiming these rebates, you can reduce the amount of tax you owe. This can lead to significant savings and free up funds for other financial goals.

Maximizing your tax savings

Smart financial planning, including investments, can complement your rebate claims and further reduce your tax liability. Consulting with a financial advisor can help you make the most of these opportunities.

Recent Changes and Updates

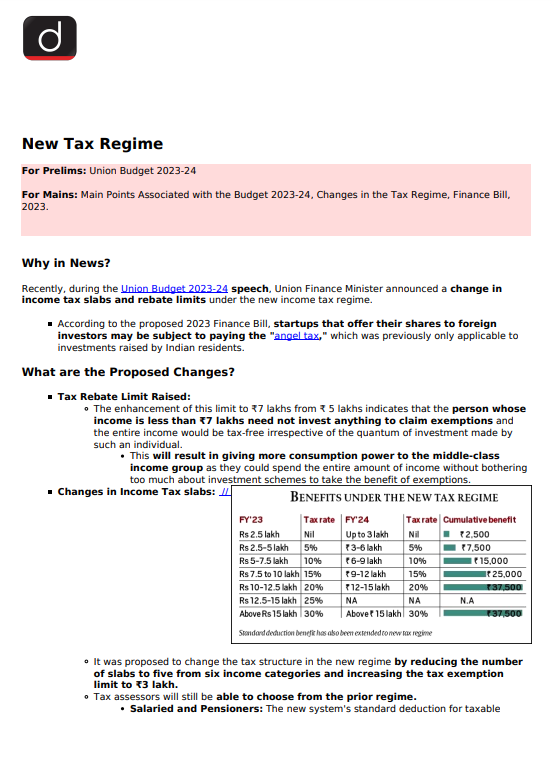

Updates in the tax regime

Tax policies are subject to change, and it’s essential to stay informed about the latest updates. Recent changes in the tax regime may impact rebate policies, so keep an eye on the news and consult tax professionals for guidance.

Tips for Tax Planning

Smart financial planning for maximum rebates

To make the most of rebates, engage in strategic tax planning. Understand your financial goals and make investments that align with the tax-saving options available.

The role of investments

Certain investments, such as tax-saving mutual funds, can offer additional tax benefits. Explore these opportunities as part of your tax planning strategy.

Conclusion

In conclusion, rebates under the new tax regime offer a valuable way to reduce your tax liability while pursuing financial goals. By understanding the different types of rebates, eligibility criteria, and the impact on tax savings, you can make informed financial decisions and enhance your financial well-being.