Reimbursement Form Template Excel – An easy-to-fill worksheet is included on a reimbursement form, which is used to track an employee’s expenses. The outlays must have supporting documentation and an individual Expense Form Number. The template automatically calculates the employee’s overall expense and allows for the entry of personal notes. The next month after you submit the form, the expenses will be reimbursed. Additionally, you can edit and add a line item for notes.

Form for Employee TA Reimbursement

Use an Employee TA Reimbursement Form if you’re in the business of covering employees’ travel expenses. There are several general aspects that you should keep in mind while constructing an employee travel expense form, even though the form itself can be rather complex. First, the form should contain some fundamental information about both the employee and the business. The form should, for instance, include the employee’s title. The employer’s complete name, including any suffixes, should also be included.

An Excel template for the Employee TA Reimbursement Form is simple to use. The employee’s personal information and expenses can be entered. The template will determine the employee’s overall expenses and each expense form must have a distinct Expense Form Number. You can add notes for yourself in the template if necessary. You can alter the reimbursement form to suit the requirements of your business because it is also editable.

Form for Mileage Claim

You can locate the appropriate formula to make your mileage claim form in Excel work for you. To figure out how much to pay your employee for the miles they’ve driven for work, you can utilize a formula that can be determined. To do this, select the Editing group after clicking on the Home tab. Excel will calculate the values in the column for you when you select the AutoSum option. Simply type =SUM(first cell) into the second box to input the sum of your mileage reimbursement and other charges.

The mileage claim form has an easy-to-use structure and uses calculations that are done automatically. The mileage log has columns for the destination, the mileage, and pertinent trip-related comments. For recording daily and monthly mileage, use this form template. By dividing the total number of miles you traveled each month by the MPG rate, you may determine the entire amount of compensation to which you are due. Anyone can use the format because it is simple to alter and personalize, especially those who are self-employed.

Cost Report Template

An expense report form can be used by the user to record travel-related costs. The user must choose a cost item, which is typically a hotel room, in order to finish an expense report. If the expense item is connected to a certain airline or hotel, it may also be a plane ticket. Only after the system administrator has activated the tax auditing tab can the expense item column be displayed. The expense report grid will appear after this option has been enabled.

The template has to list the cost, the date it was signed, and the justification for the expense. There should be space for notes as well. By modifying the report’s content, structure, and look, the template can be altered. Users have the option to combine or divide cells, adjust the border design, and resize and rearrange cells using the table toolbar. To prevent confusion while sending the expense report form to the accounting department, these details can be provided there.

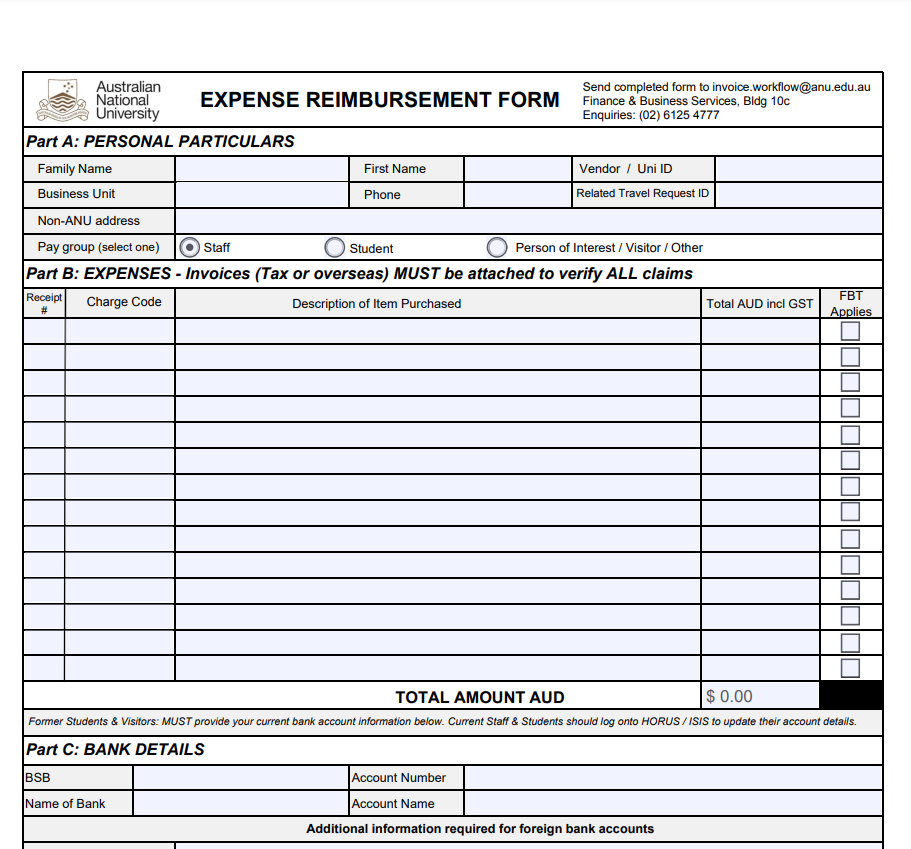

Form for Expense Reimbursement

Employees can track their expenses and submit them for compensation with the use of an expense reimbursement form template. The template has sections for the name of the individual, manager or department, date, description, and monetary value. The amount owed is totaled in the final column. The form can be printed out and manually filled out. The space is plenty for employees to enter their information. Additionally, it is simple to modify for various businesses. You’ll discover a solution, regardless of whether you need a business expenditure reimbursement form template for your company’s expenses or a personal expense form for your employees.

The itemized breakdown of expenses is the most crucial section of the form. Make sure to accurately enter the sum and, if necessary, add sales tax. Don’t forget to sign the form to show that you are the one submitting it for reimbursement. To confirm your identification and expense details, some companies may request further documents. This is why you should be careful while selecting an Excel expenditure reimbursement form template. Use a top-notch template if you want your reimbursement to be handled properly.

Template for an expense reimbursement form

Employees can submit expenditure reports using a template called an expense reimbursement form. It contains details about the expense, such as the employee’s name and department, the date, a description of the expense, and the dollar amount. The form has an area for personal notes and can be manually completed or printed. You can save time and frustration by using an expenditure reimbursement form template instead of starting from scratch to build a unique form.

When an employee requests payment for travel, office supplies, lodging, or other expenses, they must submit an expense reimbursement form. To ensure proper reimbursement, expense reimbursement forms must contain all required data. Original itemized receipts need to include the sales tax and have a general ledger number. An expense reimbursement form can be filled and submitted online or to the manager of the business.

Download Reimbursement Form Template Excel 2025