Renters Rebate Form MN 2024 – There may be a Minnesota renters refund available to you, regardless of whether you own a property or not. With the help of this program, you will receive a tax return that you can use to offset your property taxes. You may be eligible for this program if you are a homeowner or renter with unpaid local or property taxes. Renters from other states can also be eligible.

Household Credit

In Minnesota, house owners are eligible for a return based on the amount they paid in property taxes. If a homeowner has resided in their home for fifteen years and it is their primary residence, they may be eligible for this credit. For homeowners who are sixty years of age or older and have an annual income under $60,000, a homestead exemption is also available.

Renters must first sign up for the homestead credit before they may request a rent rebate. They must first sign up for a free account to do this. They have to choose a secure password and go through email verification. Users can upload documents and forms after registering. They can then add text and images to their forms to make them more unique. They can also include remark boxes and fillable fields.

The Michigan Department of Treasury advises taxpayers to look over the specifics of this homestead credit and speak with a tax expert. The homestead must be the person’s primary residence in order to be eligible for a rent rebate. The owner of the homestead must also reside in it, and the renter must have a written agreement to pay rent on the homestead. A person is also limited to one homestead claim. Second homes, cottages, and dorms at colleges are not acceptable.

application closing date

For both homeowners and renters in Minnesota, there are property tax relief options. People who are unable to pay their property taxes can benefit from the program. Elderly taxpayers over the age of 65, people with disabilities, and homeowners who live in mobile homes are also eligible for property tax relief. These people may occasionally be eligible for a refund even if they don’t live in Minnesota. To learn more about submitting an application for property tax relief, get in touch with a partner group.

To be eligible for the program, Minnesota renters must submit a rent assistance application by January 28, 2024. The processing of eligible proposals will depend on the availability of funding. Renters in Washington County might potentially be eligible for Emergency Rental Assistance (ERA) schemes. People who rent homes can also qualify for the Energy Assistance Program. This program is intended for people who have numerous missed payments and are going through a housing crisis.

Discover the potential financial benefits that await you! By meeting certain criteria, you could potentially receive an impressive rent reimbursement of up to $654 annually. That’s not all – for individuals who qualify, there is a maximum refund cap of $1,000. However, please note that income restrictions do apply to this amount. But wait, there’s more! You might also be eligible for a homestead credit refund. Don’t miss out on these opportunities for extra financial support and explore your eligibility today!

Return money

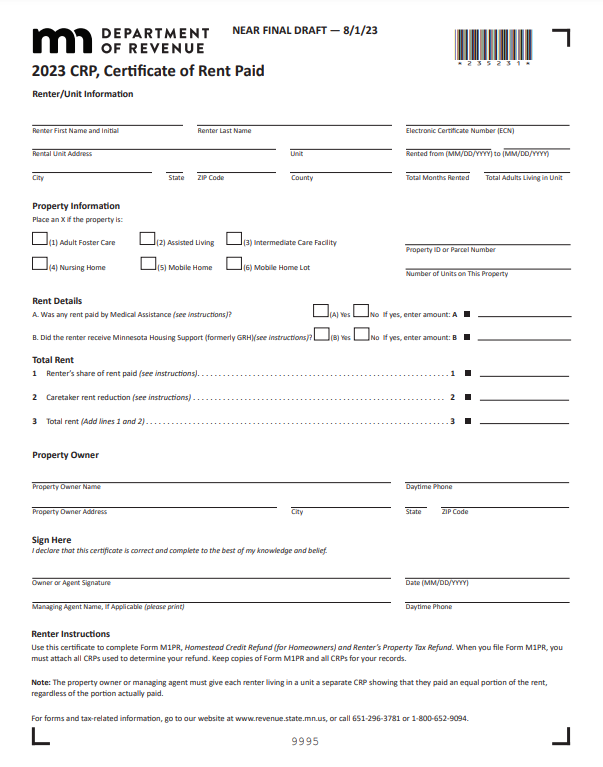

By submitting a form M1PR and the Certificate of Rent Paid, which your landlord should have sent you in January, renters can apply for a renters’ refund. Because it enables you to disclose non-taxable income, the renters’ rebate form differs from the homestead credit refund. Visit the Where’s My Refund tool of the Department of Revenue for further details regarding tenants’ refunds.

Renters in Minnesota have the option of receiving either a full refund or a partial refund. For this year, renters are eligible to receive up to $654. However, for homes that qualify, the refund amount can be somewhat higher, with the typical refund amount circling around $944. You must submit your return by August 15, 2024, if you are qualified for a refund from the Renters Rebate.

In Minnesota, tenants are also eligible for a property tax credit. They can use this credit to lower the annual amount of property taxes they have to pay. Both homeowners and renters are eligible for this tax benefit, regardless of whether they spend the entire year in Minnesota. Renters who have paid past due local or property taxes may also be eligible for this credit. You only need to download the application from the Minnesota Department of Revenue to submit it.