Renters Rebate Form – The Renters Rebate form is an invaluable resource for disabled or elderly individuals with limited incomes who are looking to ease their financial burden. By meeting certain income requirements, they become eligible for a state-mandated reimbursement program that provides much-needed relief and support.

Are you currently renting an apartment, room, cooperative housing, or mobile home? If so, there is a fantastic program available to you. This program offers renters’ rebates of up to $900 for married couples and $700 for singles. Don’t miss out on this incredible opportunity to save some money while enjoying your living space.

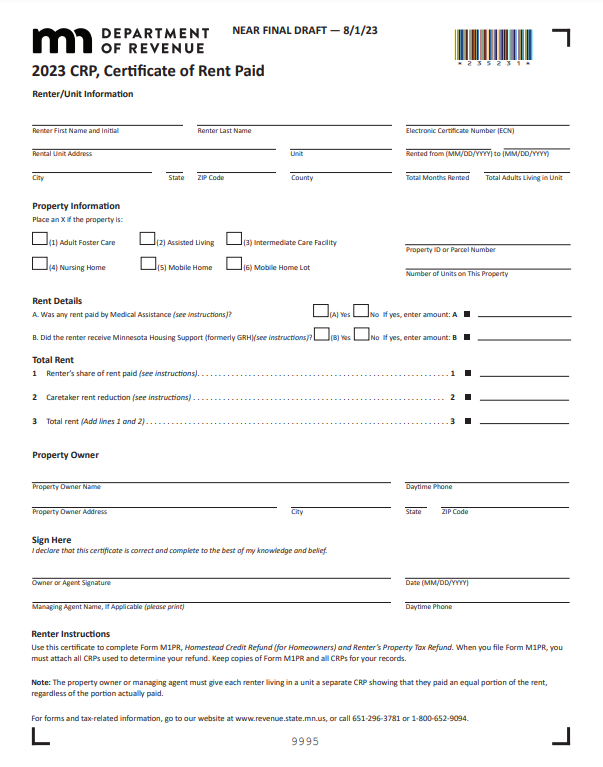

Download Minnesota Renters Rebate form 2024

Rent serves a dual purpose as it not only provides a place to live but also contributes to paying taxes. Depending on your income and the amount of rent you pay, you may qualify for a Renter’s Property Tax Rebate. This can help alleviate some of the financial burden associated with renting while ensuring that you receive the benefits you deserve.

You should have:

- An individual tax identification number or valid social security number

- Minnesota Renter, lived and paid rent

- Living in a property where property tax was assessed or payments made in lieu of property taxes

- All of the following must be true in order to qualify:

- Minnesota residents or have spent more than 183 consecutive days in Minnesota

- You can’t be claimed as a dependent upon another person’s tax return

- Your 2020 household income was below $62,960

Refunds can be claimed via software providers or on paper.

A completed Certificate of Rent Paid from your landlord is required. The CRP must be included with your return. The CRP is a measure of how much rent you have paid in the past year. When applying for your Renter’s Tax Refund, you must include a copy of the CRP. You must have a complete CRP from your landlord by January 31. You can request a Rent Paid Affidavit from your landlord to apply for the Renter’s Tax Refund.

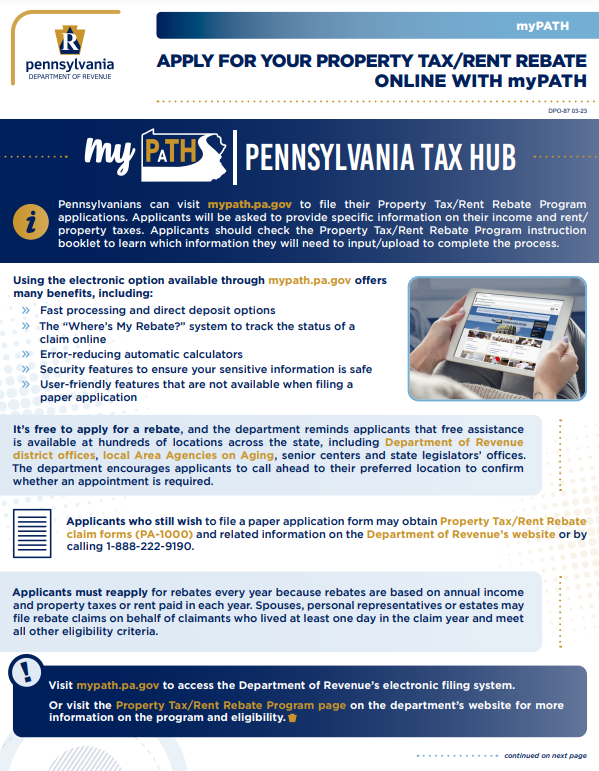

Download Pennsylvania Renters Rebate form 2024

To ensure you take advantage of the Property Tax/Rent Rebate, it’s important to have your application submitted by June 30, 2024. Don’t miss out on this opportunity to potentially receive a rebate for your property taxes or rent expenses. Act now and meet the eligibility criteria before the deadline!

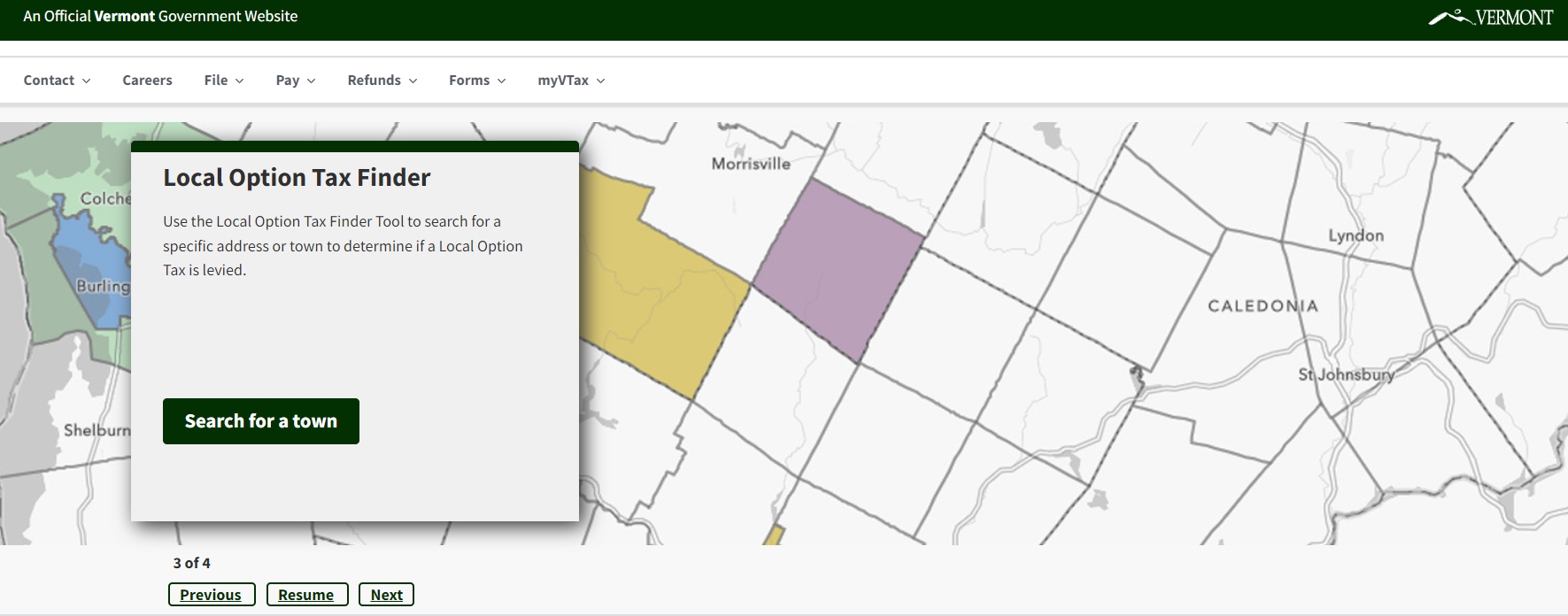

Download Vermont Renters Rebate form 2024

Take advantage of the Renter Rebate program as it offers more than just financial relief. This tax credit can be utilized to pay your taxes or even boost your refund check. Even if you don’t have any taxable income, you can still receive a check through this helpful initiative. Don’t miss out on this opportunity to ease your financial burden and potentially increase your tax refund!

To get credit, there are some very specific requirements.

- It is necessary to have a sufficient income.

- No matter if you rented in Vermont in multiple places or paid all of your rent, you must have rented in Vermont during the entire tax year. You may also be eligible if your home is sold before April 1, and you rent the remainder of the year.

- For the entire tax year, you must be a Vermont legal resident.

- You cannot be someone else’s dependent.

- The credit can only be claimed by you and your family.

The due date for your Renters Rebate Form Claiming usually falls on April 15. For 2020 taxes, the new due date for claims is May 17, 2024. Late filing is allowed, but not after October 15. You will have to pay $50 late filing fees if you file after the deadline. October 15th is the last day to file a Renter Rebate claim. This is different than most tax credits.