The South Carolina State Tax Rebate is a refundable tax credit offered to eligible taxpayers who have paid taxes on their income. This tax credit is available to residents of South Carolina who meet certain criteria, including income level and filing status. The rebate amount varies depending on the taxpayer’s income level and other factors.

Who qualifies for SC State Tax Rebate?

To qualify for SC State Tax Rebate, you must be a resident of South Carolina who has paid taxes on your income. You must also meet certain income requirements, which vary depending on your filing status. For example, a single filer must have an adjusted gross income (AGI) of $42,000 or less to qualify, while a married couple filing jointly must have an AGI of $84,000 or less. Other eligibility requirements may also apply, such as age and disability status.

How to claim SC State Tax Rebate?

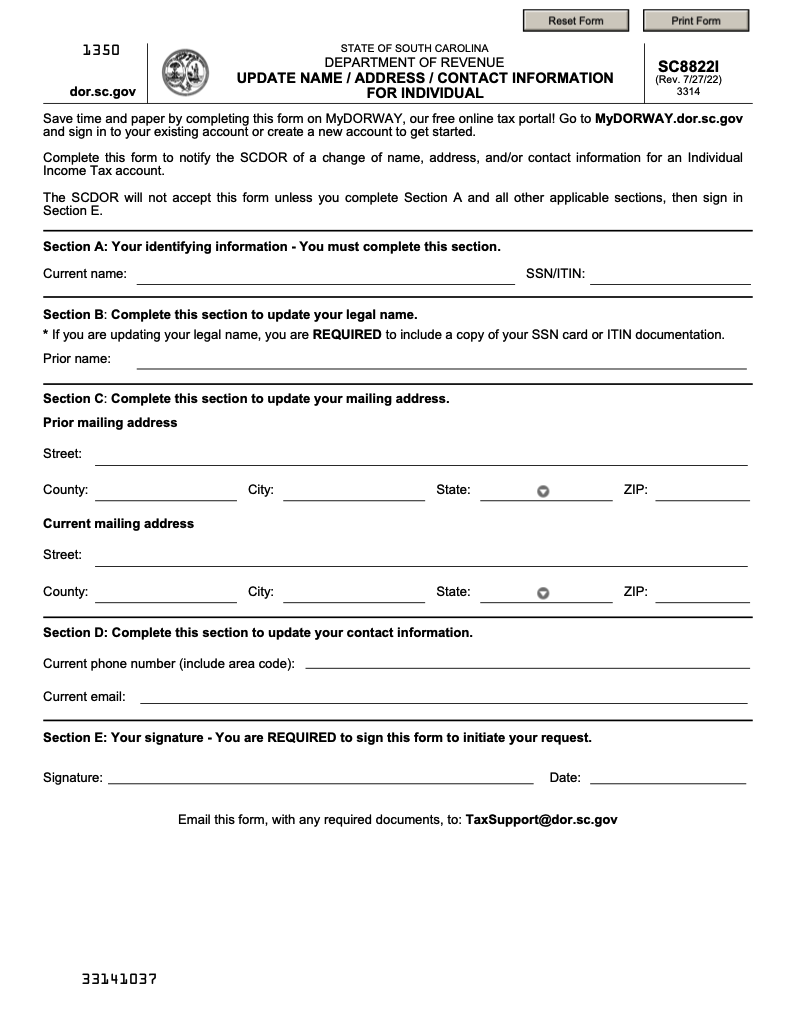

To claim SC State Tax Rebate, you must file a South Carolina income tax return and complete the appropriate tax forms. The rebate is based on a percentage of the taxpayer’s state income tax liability, so you must first calculate your tax liability for the year. You can then claim the tax credit on your return using the appropriate form.

Deadlines for claiming SC State Tax Rebate

The deadline for claiming SC State Tax Rebate is the same as the deadline for filing your South Carolina income tax return, which is typically April 15th. If you file for an extension, you will have until October 15th to file your return and claim your rebate.

Tips for maximizing SC State Tax Rebate

- Take advantage of other tax credits: South Carolina offers a number of other tax credits, such as the Earned Income Tax Credit and the Child Tax Credit, which can help increase your overall tax refund.

- Keep accurate records: Keep detailed records of all income and expenses throughout the year to ensure you are taking advantage of all available deductions and credits.

- Consider consulting a tax professional: A tax professional can help ensure you are taking advantage of all available tax credits and deductions and can help maximize your refund.

- Donate to charity: Donations to qualifying charitable organizations can be deducted from your taxable income, potentially lowering your tax liability and increasing your tax refund.

Conclusion

SC State Tax Rebate is a valuable tax credit for eligible residents of South Carolina. By understanding the eligibility requirements, claiming process, deadlines, and tips for maximizing your refund, you can take advantage of this tax credit and potentially increase your overall tax refund. Be sure to consult with a tax professional or research further to ensure you are maximizing your refund to its fullest potential.

Download SC State Tax Rebate Form 2024