Are you unsure if you qualify to receive the Vermont Renters Rebate form and if you are eligible? Make sure you know the requirements in general before you submit any claim. The claim for rebates on renters form is quite complex. It’s totally different from any rebate claim for a product. However, as you adhere to the guidelines, you’ll be in good shape.

Who Would Be Considered Eligible?

To be eligible for a rebate claim to be eligible for rebate claim, you must satisfy the necessary requirements like:

- You live in Vermont for a specific period in time for example, for the entire year 2020 (calendar calendar year) or for the whole year of 2018.

- You’re not claimed as an individual dependent of another taxpayer.

- You must have the income threshold for a typical household (within of the period of tax’s period in time)

- You’d be the sole person in the household that would be claiming for the renter rebate

- Rent for the entire 12 months in the calendar year)

In essence you have to satisfy the following three prerequisites:

- You’ve rented your home from Vermont for the whole year

- You lived in Vermont in that specific period of time period

You meet the minimum requirements for household income

It is possible that the details of the requirement may differ from year to the next. For example, you’ll need to be able to meet the minimum household income of $47,000 in the year 2019, however the figure could be closer to $48,000 in 2020. This is also applicable to the amount of renter rebate (maximum limit). It could be about $3000 for 2019, and it could be as high as $3500 in 2020. Make sure you check for guidelines on a regular basis as they are likely to alter.

How to File a Claim

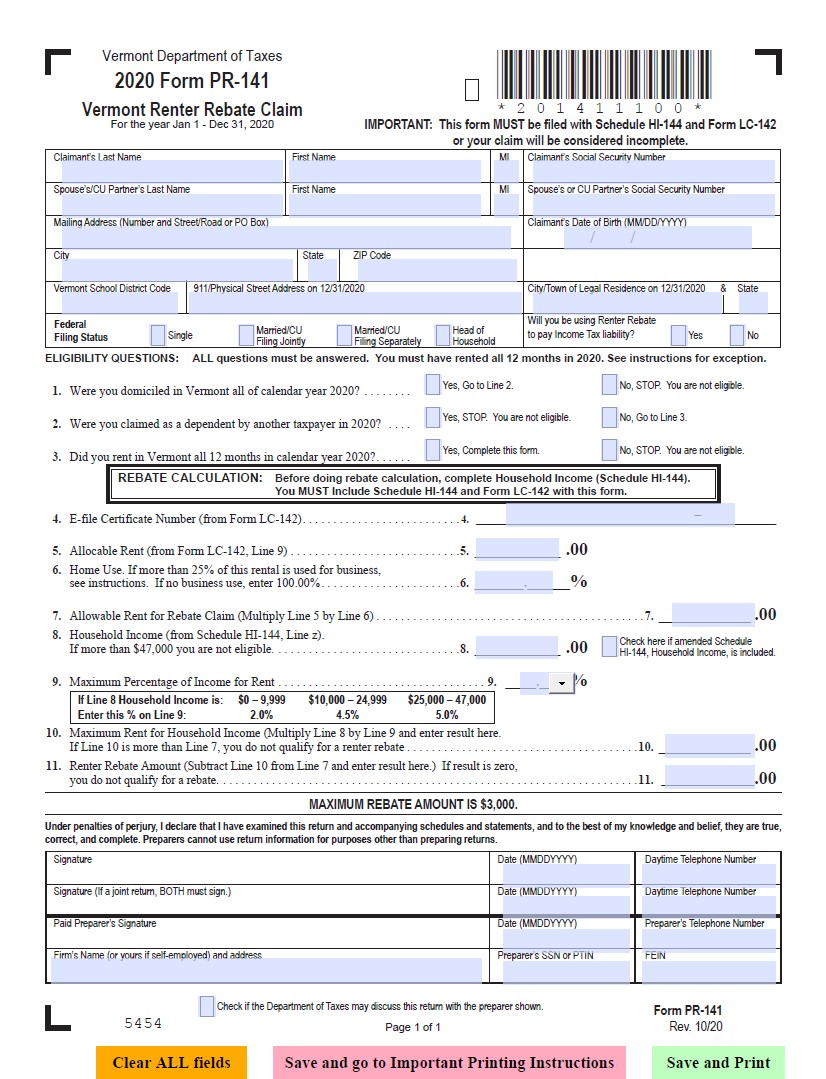

First, you must complete an HI-144 Schedule. If you’re eligible, then proceed to file a Renter Rebate Claim

- Your landlord has to supply you with Form LC142. It will display the current rent.

- Take the data from LC-142 and HI-14 to determine your (renter) rebate to be claimed on Form PR-141. The PR-141 form is the claim for renter rebate.

It is possible to complete the rebate form separate from your Vermont income tax return form IN-111. Remember that the rebate application requires three different forms. If you fail to fill out one of them the three, your claim will be denied.

Final Words

If you’re still unsure regarding how to handle your renter rebate claim you may:

- Go to legislature.vermont.gov/statutes/title/32 and see 32 V.S.A Chapter 154

- Visit myVTax.vermont.gov and file your claim online

- Visit tax.vermont.gov to find the necessary forms as well as other (facts) sheet. It also includes processing you Vermont rental rebate form

Download Vermont Renters Rebate Form 2024