Virginia Tax Rebate 2024 – The year 2024 heralds in a new era for taxpayers in Virginia with the introduction of the Virginia Tax Rebate. This exciting change in policy is a topic worth delving into for anyone interested in making the most out of their fiscal opportunities.

What is a Tax Rebate?

First off, let’s cover the basics. A tax rebate is essentially a refund on taxes when the tax liability is less than the taxes paid. It’s like the government saying, “Hey, you’ve paid too much. Here’s your change.”

Importance of Tax Rebates

Tax rebates can be an important lifeline for many. They reduce the overall tax burden on individuals and businesses, facilitating economic growth. Picture it as a cash injection that revitalizes the local economy.

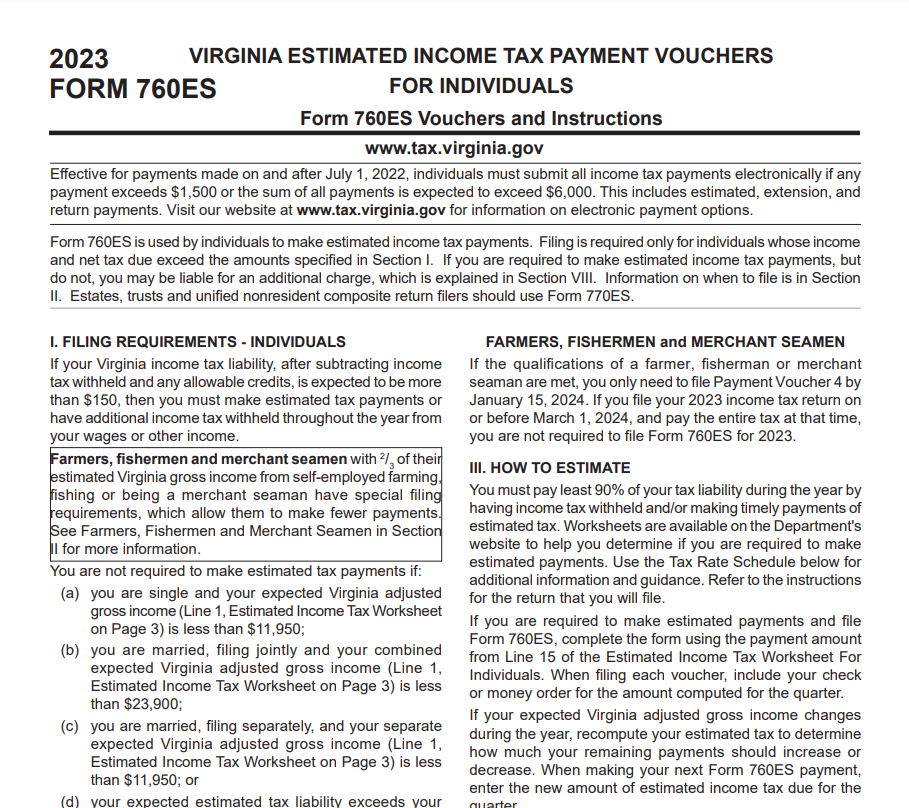

Understanding the Virginia Tax Rebate 2024

Now, let’s dive into the specifics of the Virginia Tax Rebate 2024.

Eligibility for the Virginia Tax Rebate

Qualifying for the rebate involves certain criteria.

- Residential Eligibility

For residents, it’s based on income, filing status, and other factors outlined in the tax code.

- Business Eligibility

For businesses, it’s about the kind of business, gross receipts, and a host of other parameters.

How to Apply for the Tax Rebate

Now, let’s talk about the application process.

- Required Documents

Have your tax documents at the ready. You’ll need your W-2s, proof of identity, and other relevant documents.

- Application Process

The process usually involves filing your state tax return with the appropriate rebate form.

Benefits of the Virginia Tax Rebate 2024

And what does this mean for you?

For Individuals and Families

It means less financial stress and potentially more money for groceries, bills, and maybe even a family trip.

For Businesses

For businesses, it could mean more capital to invest back into the business. Perhaps it’s time to upgrade that old equipment?

Common Misunderstandings about Tax Rebates

There are a lot of misconceptions about tax rebates. They’re not handouts, they’re not difficult to apply for, and they’re definitely not too good to be true.

Conclusion

The Virginia Tax Rebate 2024 represents an opportunity for Virginians to lessen their tax burden and boost the state’s economy. With careful planning and understanding, you can take advantage of this fiscal policy to better your financial situation.

FAQs

- Q: What is the Virginia Tax Rebate 2024?

- A: The Virginia Tax Rebate 2024 is a fiscal policy that allows taxpayers in Virginia to receive a refund on their taxes if they’ve paid more than their tax liability.

- Q: Who is eligible for the Virginia Tax Rebate 2024?

- A: Both individuals and businesses can qualify for the Virginia Tax Rebate 2024. Eligibility for individuals is based on income, filing status, and other factors outlined in the tax code. For businesses, it’s based on the type of business, gross receipts, and other parameters.

- Q: How can I apply for the Virginia Tax Rebate 2024?

- A: You can apply for the Virginia Tax Rebate 2024 by filing your state tax return along with the appropriate rebate form. Make sure to have your tax documents, such as your W-2s and proof of identity, ready.

- Q: What are the benefits of the Virginia Tax Rebate 2024?

- A: The Virginia Tax Rebate 2024 can lessen the financial stress on individuals and provide more capital for businesses to invest. It’s like a cash injection that can help to revitalize the local economy.

- Q: Are there any common misunderstandings about tax rebates?

- A: Yes, there are many misconceptions about tax rebates. Some people think they’re handouts or too good to be true. Others believe they’re difficult to apply for. However, tax rebates are a legitimate fiscal policy that can benefit individuals and businesses alike.

Download Virginia Tax Rebate 2024