Washington Tax Rebate 2024 – In 2024, the Washington Tax Rebate has undergone significant changes that taxpayers should be aware of. This post will provide an in-depth look at these modifications and how they may affect you.

What is the Washington Tax Rebate 2024?

The Washington Tax Rebate 2024 is a state-wide initiative designed to provide financial relief to taxpayers. It involves a reimbursement, or a ‘rebate,’ given to eligible taxpayers, reducing their overall tax liability.

How the Washington Tax Rebate 2024 Works

In essence, the Washington Tax Rebate 2024 works by returning a portion of the taxes paid by eligible taxpayers. This means that once you’ve filed your taxes, the state calculates the rebate amount based on your income and tax bracket. This amount is then returned to you, thereby lowering your overall tax burden.

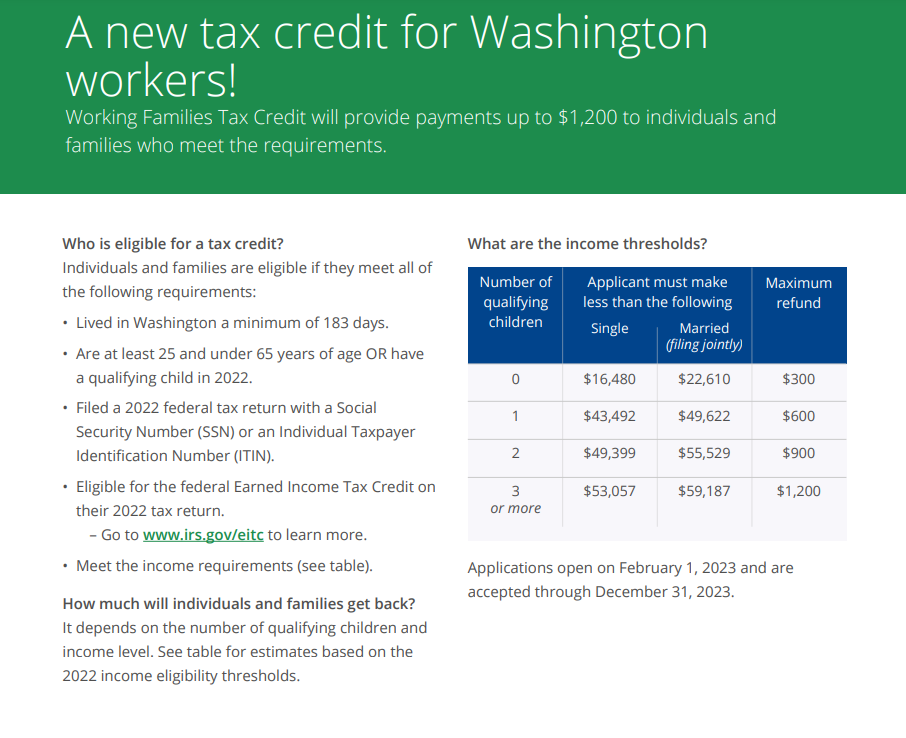

Eligibility for the Washington Tax Rebate 2024

To be eligible for the Washington Tax Rebate 2024, taxpayers must meet specific criteria. This includes being a resident of Washington State, earning within certain income brackets, and not having any outstanding state tax liabilities.

How to Apply for the Washington Tax Rebate 2024

Application for the Washington Tax Rebate 2024 is typically done during the process of filing your state income taxes. During this process, you’ll need to provide necessary information to determine your eligibility and calculate your rebate. Keep in mind that it’s always a good idea to consult with a tax professional to ensure accuracy.

Benefits of the Washington Tax Rebate 2024

The Washington Tax Rebate 2024 offers several benefits. First, it helps to ease the financial burden of taxpayers, especially those in lower income brackets. Secondly, it encourages tax compliance, as the rebate is only applicable to those without outstanding tax liabilities. Lastly, it stimulates economic activity, as the rebate puts more money into the pockets of consumers.

The Application Process for Washington Tax Rebate 2024

Applying for the Washington Tax Rebate 2024 doesn’t need to be a daunting task. Here’s a step-by-step guide on how to apply:

- Tax Filing: The application process begins with filing your state income tax return. The Washington State Department of Revenue provides comprehensive guides and forms to help you with this process.

- Providing Information: During the tax filing process, you’ll be required to provide information relevant to your rebate, such as your income level and residency status.

- Consulting a Professional: To ensure accuracy in your application and to maximize your potential rebate, it might be beneficial to consult a tax professional. They can guide you through the process and provide expert advice tailored to your specific circumstances.

The Impacts of Washington Tax Rebate 2024

The Washington Tax Rebate 2024 is not just a financial relief measure; it has broader impacts on the state’s economy:

- Economic Stimulus: By putting more money back into the hands of consumers, the rebate acts as an economic stimulus. Consumers are likely to spend their extra cash, boosting local businesses and driving economic growth.

- Encouraging Compliance: By offering rebates only to those without outstanding tax liabilities, the initiative encourages tax compliance. This ensures a steady flow of revenue to the state, which can then be invested in public services and infrastructure.

- Reducing Inequality: By providing larger rebates to lower-income households, the Washington Tax Rebate 2024 helps to reduce income inequality. This progressive approach is designed to provide greater financial relief to those who need it most.

Conclusion

The Washington Tax Rebate 2024 is a significant aspect of the state’s tax landscape. It provides significant benefits to taxpayers, stimulates economic activity, and encourages tax compliance. As a taxpayer, understanding this rebate and its implications is essential in managing your financial responsibilities efficiently.

Download Washington Tax Rebate 2024