What Does The Recovery Rebate Form Look Like – You must be familiar with this form in order to submit a recovery rebate claim. The Worksheet, Calculation, and Eligibility are the three basic divisions. Let’s examine each one individually. You may learn more about the purpose of the form in the first section. Depending on your filing status, the second part will tell you what you need to do to be eligible.

Worksheet

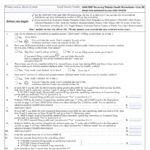

The federal government offers economic impact payments, also referred to as stimulus payments, and one of their components is a worksheet for the recovery rebate credit. By double-clicking the Recover Rebate Cr file or by hitting the F6 key on your keyboard, you may access this worksheet. The spreadsheet automatically fills in with information from the return, such as your filing status, the number of people who depend on you, and your social security numbers.

Page 59 of the 1040/1040-SR instructions includes the Recovery Rebate Credit Worksheet. Lines 1 through 11 make up the recovery rebate credit. This worksheet also demonstrates how the credit transfers to Line 30 of Form 1040.

Calculation

If they are eligible for the program, taxpayers can claim the Recovery Rebate Credit as a tax benefit on their federal income tax return. To be eligible, though, a few conditions must be satisfied. The first step is to ascertain your eligibility. The refund is automatically calculated on your 2020 tax return if you satisfy all the requirements. If you are ineligible to receive the Recovery Rebate Credit, you can check that box.

The Recovery Rebate Credit can lower your tax obligation and is 100% refundable. On line 30 of your Form 1040, you claim the credit.

Ineligibility

You can use the Recovery Rebate tax credit to lower your overall tax burden. It allows you to pay less in taxes than you earned.But in order to qualify, a number of requirements must be met. The Internal Revenue Code defines a resident alien as the first requirement. If a foreign person satisfies specific criteria, such as having a green card or having a significant amount of presence in the US, they are regarded as resident aliens for income tax purposes.

Second, if you received Economic Impact Payments from your employers in 2020 or 2021, you may be eligible for the Recovery Rebate Credit.However, you are required to submit a tax return for the year in which the payments were received. You are ineligible to claim an additional credit on your 2020 tax return if the amount you received was zero. However, you are eligible for the full Recovery Rebate Credit for 2020 provided you get a positive sum from these payments.

The filing status determines eligibility.

You might be qualified to use the Recovery Rebate Credit if you are a dependent and file a tax return each year. The credit is determined using the information on your 2020 tax return. To avoid claiming this credit, simply tick the box that says “Taxpayer is not claiming Recovery Rebate Credit.”

Furthermore, if you are a veteran, you may be entitled to an automatic recovery rebate. If you’re eligible, this rebate is free and refundable. You can fill out the form and learn more about how much money you are eligible to get. Consult the IRS’s frequently asked questions if you’re unsure.

Unqualified taxpayers

You may be qualified for a recovery rebate tax credit if you got a stimulus check. It’s crucial to keep in mind that you can only apply for the credit if you meet the income requirements. If you’re unsure if you qualify, get in touch with the IRS or check using the “Get My Payment” feature.

You may be eligible to file for a recovery rebate credit for a number of reasons. If your income decreased in 2020, your marital status changed, or your dependents changed, you might be qualified for a credit. Furthermore, since you didn’t ask for the economic impact payment, you might not have been qualified to receive it.

Download What Does The Recovery Rebate Form Look Like 2024