Where To Mail Pa Property Tax Rebate Form – You can benefit from a new rent rebate program if you own property in Pennsylvania and have been unable to pay your property taxes for a number of years. The government has boosted the funding for the initiative, which will benefit those with modest incomes. May 31 is the application deadline. You also need to demonstrate your ownership on your property tax statement, among other conditions.

application closing date

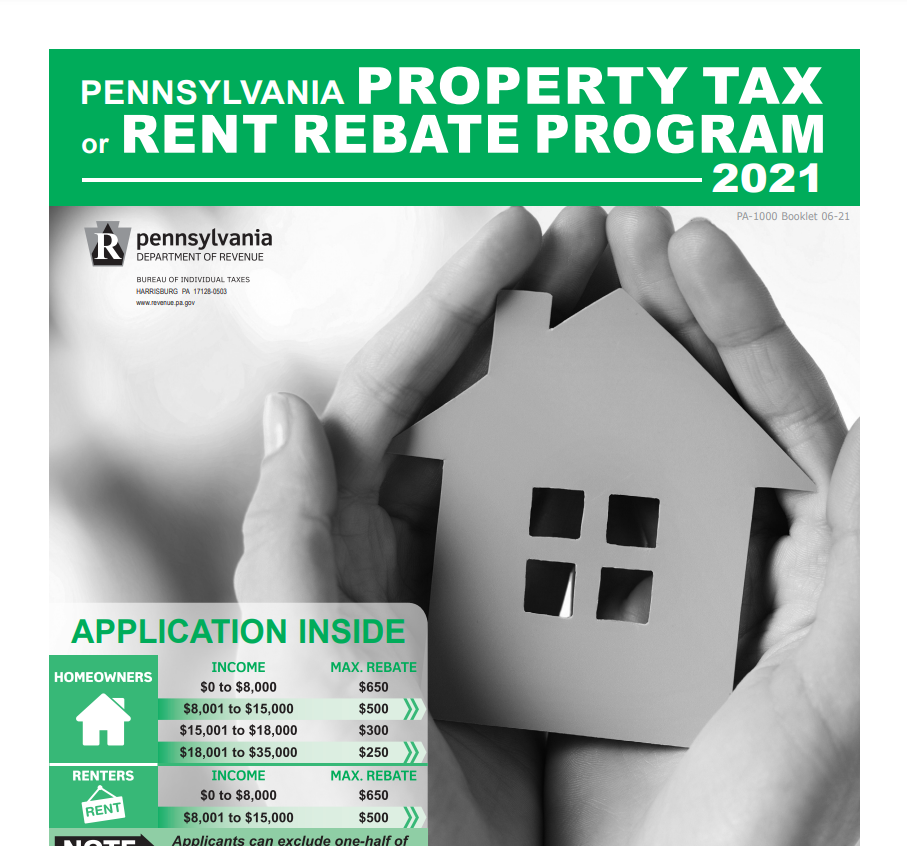

You can apply for a Pennsylvania property tax rebate in a number of different ways. In order to determine whether you are eligible for the rebate program, first check with your local government. You might be awarded up to $650 if you do. Philadelphians, Pittsburghers, and Scranton residents may also be qualified for an extra rebate. Also keep in mind that if you are an elderly homeowner or disabled, you may be eligible for additional refunds.

Once you’ve established your eligibility, submit your application online via myPATH, the Department of Revenue’s online filing platform. On the website for the Property Tax/Rent Rebate Program, there are additional instructions and a paper application. Applying by mail is another option. Visit the Pennsylvania Department of Revenue website for further details.

The deadline for submitting an application for a Pennsylvania property tax rebate has been extended for older persons and people with disabilities until December 31. The state is also providing a one-time bonus refund for this filing period, which would double the rebate amount, in addition to extending the deadline for submitting applications.

Residents must have paid property taxes or rent in the previous calendar year to be eligible for the program. Early September 2025 will bring a one-time bonus rebate of 70% of the initial rebate amount for those who fulfilled these prerequisites. Additionally, inhabitants must be 65 years of age or older, a widow, a widower, or a person with a disability in order to qualify. Renters must make less than $15,000 per year, while homeowners are restricted to $35,000 per year. Also not eligible for the rebate is half of Social Security income. Additionally, individuals with disabilities may utilize personal representatives or spouses to submit the claim on their behalf.

payment strategy

Applications for the program to reimburse property taxes are free of charge and accepted by the Pennsylvania Department of Revenue. You can go to their website for further details. For anyone who require assistance filling out the forms, they also provide free support. To learn more about the property tax rebate program, you can also contact your local Area Agencies on Aging or state legislators’ offices.

Either a direct deposit or a printed check are options. You will save time and money if you choose for direct deposit. Additionally, it is a safer method of receiving your rebates than a physical check. Your application and reimbursement will be handled by the Pennsylvania Department of Revenue.

Your payment will be delivered by the Department of Revenue via direct deposit or the postal service. If you selected to get your rebate via paper check, you can anticipate receiving it in the first few days of July. On the application form, you should include the details of your bank account if you’d want to receive it via direct deposit. If you opt for direct deposit, you will have your money in a couple of weeks.

The Pennsylvania Lottery provides funding for the initiative. For the 2019 and 2020 tax years, more than 400,000 people have received payouts from the program. The program also provides additional funding for those with disabilities. You may qualify for an extra rebate if your income meets certain criteria. The value of the extra rebate is equal to 70% of your original rebate.

Download Where To Mail Pa Property Tax Rebate Form 2025