MN Renters Rebate Form 2024 – Both homeowners and renters in Minnesota may take advantage of a special scheme for property tax refunds. You can find out more information about this program and how to apply. Additionally, you can learn about any modifications to this program. The application date for this unique initiative to refund property taxes is March 15, 2015.

Deadline for MN Renters’ Tax Credit Applications

You should be aware that the Minnesota renters’ tax credit deadline is approaching if you reside in Minnesota. In the state, rents are growing quickly while incomes are not keeping up. Policymakers can reduce the impact on renters’ finances by increasing the size of the renters’ tax credit. More people who are having trouble paying their rent would benefit from a larger renters’ credit in this period of economic crisis and pandemic. Extending the program will provide Minnesotans with the necessary respite, which is a fantastic idea.

Don’t miss out on this opportunity! Make sure to submit your application before the deadline of August 15th. In just 60 days after filing, you can expect to receive a well-deserved return on your investment. And here’s an even better incentive – if you are the owner of the property, you might be eligible for an even larger refund. To find out more about your eligibility and take advantage of this potential windfall, head over to the Department of Revenue’s website today!

Did you know that as a renter in Minnesota, you are eligible for a property tax return? This incredible tax benefit is designed to make your life easier. With over 314 thousand homes able to access this program, it’s clear that many people are taking advantage of it. The best part is that the credit you receive is based on the total annual rent paid, providing further relief for your wallet. And let’s not forget about the added bonus of helping to offset your tax preparation expenses. It’s truly a win-win situation!

Refunds for Minnesota renters’ tax credits come in two different varieties. You might get both, depending on the kind of rental property you own. The average refund for a renter is $654, while the average refund for a homeowner is $1,060. Renters and homeowners in Minnesota are reminded to file their taxes by the deadline of August 15.

Rental and homeowner property tax refund programs in Minnesota

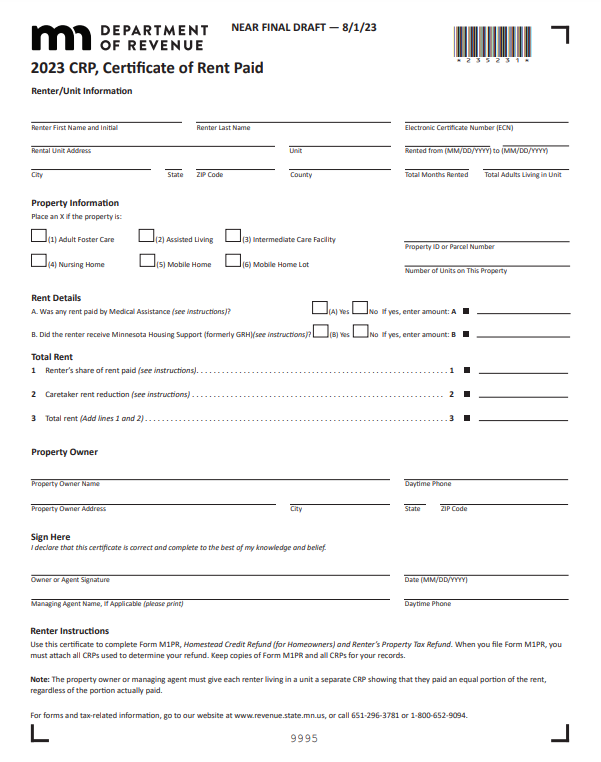

For homeowners and renters to receive a property tax refund, the Minnesota Department of Revenue provides a specific program. The entire amount of property taxes that a homeowner or renter paid on their primary residence between January 2 of the following year is the basis for these tax refunds. Typically, you can receive a refund of up to $600 from your property taxes. However, a variety of variables, including as household income, the number of dependents, and Minnesota residency, affect the amount of the return you are eligible for.

Homeowners who live in the state must be residents in order to qualify for a homestead property tax refund. Your property tax must have increased by at least 12% in order to qualify. Additionally, the rise cannot be attributable to your property’s renovations. Furthermore, to be eligible for a homestead tax refund, your income must be less than $150,000.

Depending on their household income, homeowners and renters can obtain a maximum rebate. If a homeowner files their property tax return in 2019 or 2018 and is a homeowner, they may be eligible for a refund of up to $2770. If a renter makes less than $59960 per year and rents their home, they may receive up to $2150.

Through the Renter’s Property Tax Return, renters may also be eligible for a property tax refund. These refunds are available for up to a year following the due date for property taxes. You must turn in your property tax statement, which the county issues each spring if you rent out your house.

Changes to Minnesota’s unique property tax rebate program

State legislators are considering a new plan that would alter Minnesota’s unique approach for property tax refunds. The measure would simplify the eligibility requirements for the credit. Homeowners would just need to meet income limits of less than $119,790 under the new program. They would also have had to raise their property taxes by at least 12% in 2021 or 2024. The renter’s credit, which is currently a nonrefundable income tax benefit, would likewise be converted into a refundable income tax credit under the proposed legislation.

A 6.9% rise in the property tax levy is anticipated in the budget for 2024. The adjustments could result from adjustments in the tax levy and property market values. The City of Saint Paul has created a property tax estimator to help individuals comprehend how their taxes are anticipated to vary and the anticipated changes in property taxes. Homeowners can also visit the website of the Minnesota Department of Revenue for more information.

A tax bill that would reduce tax refunds for those in the lowest income groups by nearly $509.6 million over three years is being considered by the state. The state’s tax receipts are also anticipated to decrease by more than $1 billion over the following two years as a result of the elimination of the state income tax on Social Security.