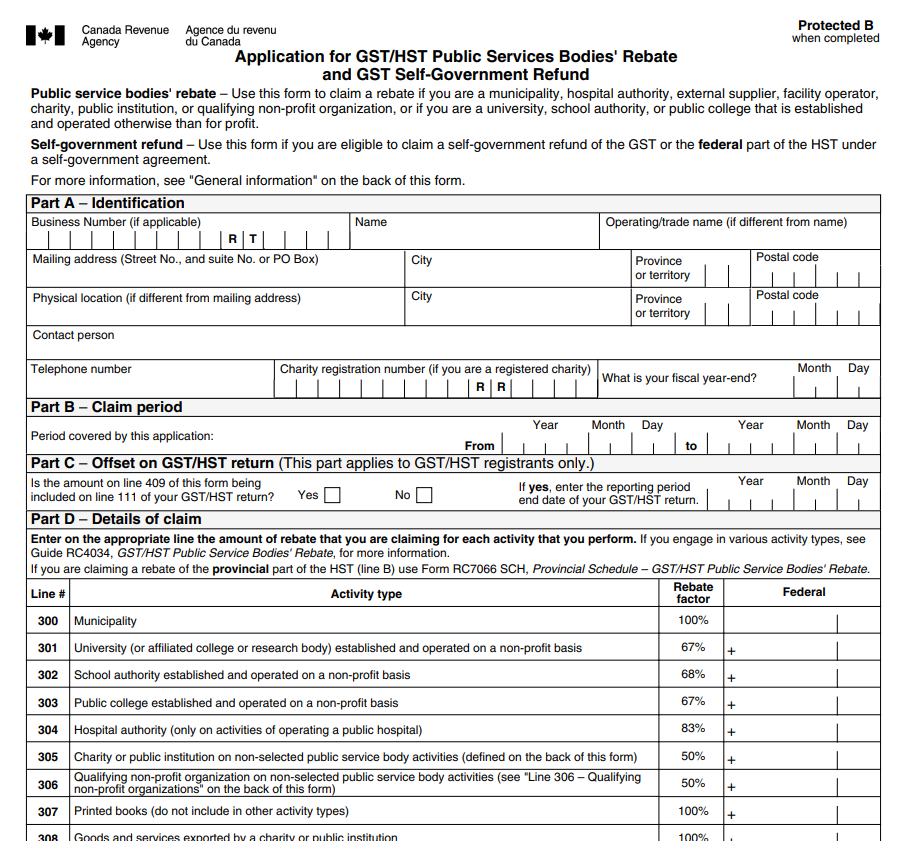

HST Charity Rebate Form Ontario – To recover a percentage of the HST or GST it has paid on particular expenses, a charity may be eligible for a HST Charity Rebate Form Ontario. To receive the rebate, though, there are some conditions that must be satisfied. First, the company must save all documents including original invoices for a minimum of six years. Second, during a fiscal year, it must submit its claim at least twice.

Churches are exempt from GST/HST registration requirements.

If a church is not participating in fundraising, it is not required to register for GST/HST charitable rebates. Certain goods and services, however, may be exempt from GST/HST. Food, drinks, and temporary housing are just a few of these goods and services that are available to those in need. Charges for cooked meals given to senior citizens or people in need are likewise exempt from GST/HST.

To register for GST/HST, a charity must be registered. A charity must fulfill two requirements in order to be eligible: first, it must generate at least $250,000 in gross income during a tax year; second, it must have provided at least $50,000 in taxable supplies over the four preceding calendar quarters.

The choice to register as a small supplier division is up to the organization. It can be eligible for the rebate if it produces less than $50,000 worth of taxable supplies. It cannot, however, claim an ITC for purchases made in support of the charity.

NGOs are eligible for a property tax credit.

There are two options available to churches that want to apply for an Ontario HST charitable reimbursement. The first method entails completing a form. The HST’s provincial component can then be claimed. You must maintain your records for six years.

Contacting the Revenue Canada charity office is the second option. You can get help from this office with your application. Be careful to employ the appropriate format. You will require your Registration Number from the Canada Revenue Agency. Make sure you are performing the calculations in the proper manner as well. Making the most of the HST you can donate to charity requires using the right procedure.

A charity cannot request a GST/HST reimbursement unless it has registered with the government. A charity must have at least $50 in taxable supplies donated over the previous four calendar quarters and more than $250,000 in gross revenue to qualify for this.

Churches are eligible for a GST/HST refund.

You’re in luck if you’ve been wondering how to apply for a GST/HST charity rebate on the cash you donate to charitable causes. You can easily recover the money you spent on charity endeavors in Ontario by following a straightforward procedure. You must first be aware of what your church can assert. You are allowed to deduct a portion of the HST you paid for expenses twice or three times per year. You must preserve the original bills and records for up to six years in order to submit a claim.

Your organization must register with Canada’s GST/HST department in order to be eligible for a GST/HST charitable reimbursement. Your organization must fulfill certain requirements, such as having more than $250,000 in gross income each fiscal year and $50,000 in taxable supplies over the previous four quarters, in order to qualify for this. Additionally, you’ll need to provide proof that your company is a nonprofit.

There is useful information regarding getting a charity rebate on the tax department’s website. Filing is simple. You must fill out a charity rebate form to achieve this. After that, you must submit all supporting paperwork and records.

Churches are eligible for a property tax refund.

Churches differ from other nonprofit organizations in their tax status. These institutions are free from real estate taxes. They have the option to refuse the tax benefit if they so choose, according to the Internal Revenue Code. They can freely discuss politics and candidates, but they should avoid engaging in political advertising. Additionally, the government loses billions of dollars annually due to the tax benefit for churches.

Although the tax code is advantageous to places of worship and religious leaders, it has also come under fire from renowned legal scholars. For instance, it’s not obvious if pastors of megachurches are eligible for the parsonage stipend if they live in lavish mansions. This is so that the parsonage allowance can only come from money that has been really donated to the church. Additionally, properties held in trust or co-ops are not eligible for the exemption.

New churches and religious institutions are being founded in New York as the city’s population grows more spiritual. Older religious groups, who typically hold their tax-exempt properties for as long as feasible, are unfortunately robbed of their tax base by this practice.

Download HST Charity Rebate Form Ontario 2025