MN Renters Rebate Form – The best approach to reducing your tax burden is to use the MN Renters Rebate Form. You are eligible for this rebate if you own a rental property and your property tax is disproportionately high compared to your household income. You must fulfill a digit of requirements in charge to stand suitable for the taxation recognition.

Tax relief for people whose property taxes are disproportionate to their household income.Minnesotans who own a home are in luck. Owners and tenants who pay overdue property taxes are eligible for a refund from the state of Minnesota. The refund is a significant factor in the state’s ranking as the third most affordable in the nation for housing.

The best thing about the refund is that you actually get a reimbursement from the government, so you don’t lose any money. You may even be eligible for the state’s Working Family Credit if you complete the conditions. For families struggling to make ends meet, this tax benefit makes perfect sense. The tax credit is especially advantageous for homeowners looking to buy a new house, a second home, or a rental home.

One of the most compelling aspects of the rebate is that it extends its benefits to a wider audience. In addition to those who qualify for the tax credit mentioned earlier, even individuals who are renting and reside in different states or have been living in Minnesota for a minimum of one year can also enjoy this reimbursement opportunity.

Increasing the renters’ credit would also address Minnesotans’ extreme hardship during the pandemic and economic slump.Currently, individuals of color make up around 80% of the country’s renters. This reflects the historical exclusion of people of color from homeownership due to legislation. Additionally, communities of color take a excessive allocation of the burden of rental costs. These communities find it harder to escape eviction and foreclosure as a result. Furthermore, the longer-term health of renter families may be impacted by the higher chance of foreclosure and bankruptcy.

Unemployment and housing instability affected millions of Americans during the economic slump and the coronavirus outbreak. Evictions and foreclosures increased as a result, which might result in urban degradation. Children suffer the most from these problems since instability can have long-term negative effects.

Renters are finding it harder and harder to make ends meet as the housing market continues to deteriorate. Many people borrow money or need government aid to cover their rent. Some people pay with credit cards as well. The Week 12 Housing Pulse Survey from the Census Bureau indicates that these payment methods climbed by around 20% in April and May.

Conditions for requesting a refund

If you’re a resident of Minnesota and looking to get a property tax refund, there are several avenues available to you. Depending on your income level, you can choose from various options such as tax statements or refund forms. Whether you own a home or rent, there are several tax relief options that cater to your specific needs. Don’t miss out on the opportunities available to help alleviate some financial burden!

Finding out what you are qualified for is the best method to submit a claim for a property tax refund. For instance, if you live in a nursing residence or helped breathing facility, you may qualify for a tax refund. A homestead credit is something you may be eligible for if you own a home. If you satisfy the requirements, you might receive up to $2,930.

Renters may potentially be qualified for a property tax refund, particularly if they have stayed in Minnesota for at least 183 days. This part of duration is better than sufficiently to apply for modest property tax relief. Renters who applied for the state’s property tax rebate actually received around $654 back.

E-filing

Fortunately, Minnesota provides a method to assist you in monitoring the status of your refund. You can submit your MN Homeowner and Renter Reimbursement Form online with eFile Express and get your refund as soon as Minnesota law permits. This is a fantastic strategy to lower your filing costs. Additionally, it fixes mistakes before you file your return. You can get your reimbursement as soon as you file, and using eFile Express is free.

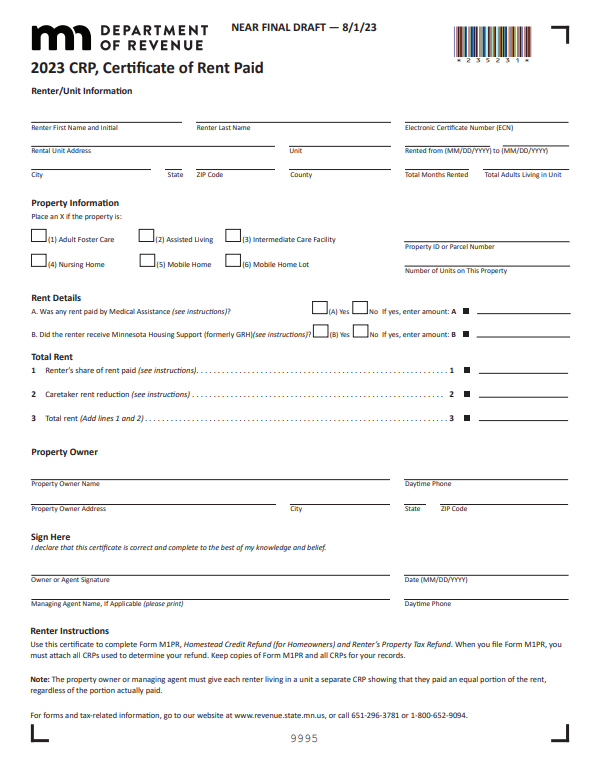

You can receive a credit for each rental unit you own when you submit your MN Renters Rebate Form. Living together with your spouse may make you eligible for a joint credit. Even if your tenant didn’t submit a tax return, you can still claim your credit. For each rental unit you own, a Certificate of Rent Paid (CRP) is required. Additionally, you must confirm that your landlord completes the CRP and provides it to you by January 31 of the tax year.