It’s unfortunate that there aren’t many people who know about the PA Rent Rebate form and can benefit financially from the perks associated with it. If you’re among the people who are qualified for the rebate, keep reading to find out the steps.

Learning More About PA Rent

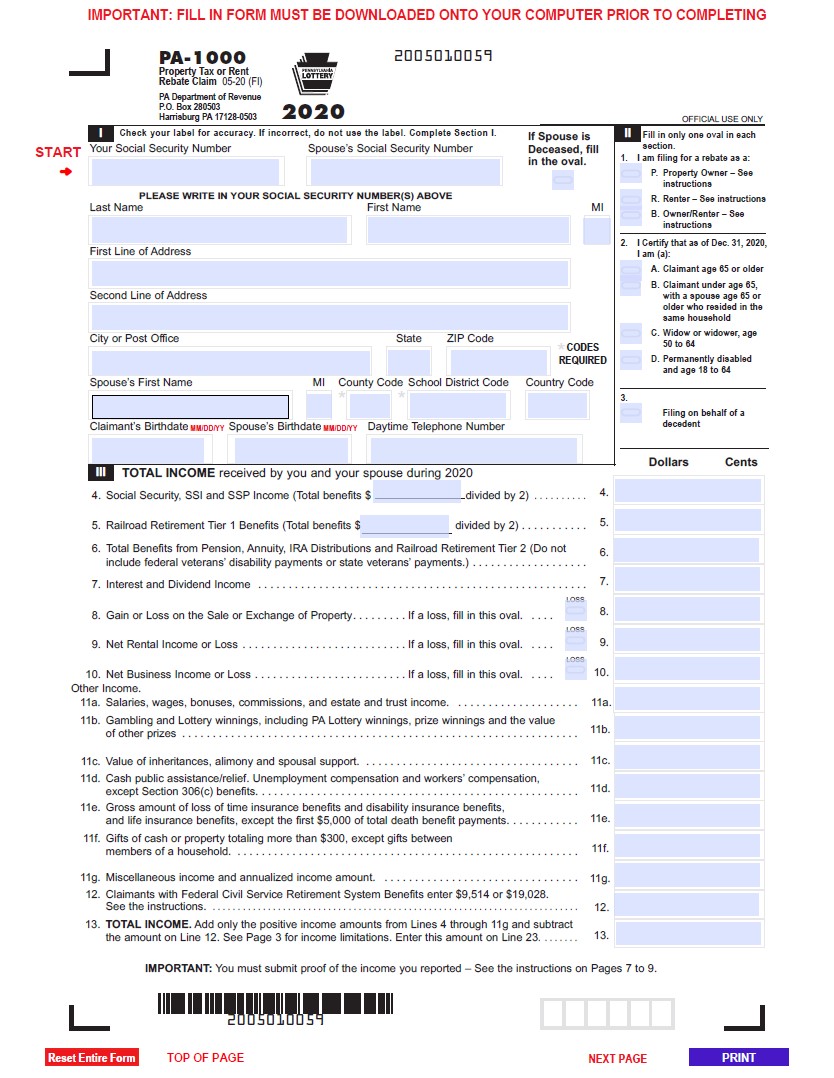

PA is short for Pennsylvania. PA rebates are a part of the property tax or property rent. It is only possible to claim PA rent rebates if you need to handle the taxation of property or rent. PA (Pennsylvania) Rent Rebate or Property Tax is a scheme that offers refunds on rent paid or property tax in the previous year. It is used by anyone who is disabled or qualified seniors.

So, who is considered to be eligible for the cash rebate? It is specifically targeted for Pennsylvania residents (who are income-eligible) who are 65 years old or over. People who have disabilities and are 18 (and over) can also be eligible. Widowers and widows who is over 50 (and older) may be eligible for the cash rebate as well.

How Much Would the Rebate Be?

The amount of the standard rebate is set at around $650 as the maximum amount, however, supplementary rebates (for homeowners who are eligible) could increase to $975. To qualify for this rebate, income threshold for homeowners is $35,000 per year, while for renters, it’d be $15,000 annually.

Half of Social SecurityA income would be exempted. In the event that you’re an estate administrator, personal representative, or spouse, you are able to make (rebate) claim on behalf of the person who meets the requirements and who lives at least a full day in the house.

Providing Information for the Rebate

If you’re interested in applying for the rebate program, you’ll need to:

- Go to State Section

- Choose Pennsylvania Return

- Pick Miscellaneous forms

- Select form PA-1000 to claim a rebate or Property Tax

The rebate is typically given in the year following your tax-year. If, for instance, you paying the tax in 2020. Then you’ll get an amount of rebate 2024. It is necessary to submit application (and be sure to contain the proper documents) via rebate programs (for property taxes or rent) which you have paid prior to the year. The rebate request will be processed, and disbursed on a first-in, the first-out basis.

The Facts regarding the Rebate Program

Be aware that you’ll need to send in the form. While others (Pennsylvania) form can be electronically filed but the PA-1000 form cannot submit electronically. It is required to print it out , and then mail it to the address below. You should separate it and your Pennsylvania return. Don’t mix them together.

If you’re still confused regarding the whole issue you can contact the district office of the PA Department of Revenue at your location. They’ll be able assist you in filling out the PA Rent Rebate form.