PPI Tax Rebate – Are you aware of the PPI tax rebate and its potential to put money back in your pocket? This article will delve into PPI tax rebates, explaining what they are, who can claim them, how to go about it, and why it’s essential. You might have been impacted by PPI mis-selling, and if so, you could be entitled to a significant rebate. Read on to discover the ins and outs of this financial opportunity.

Understanding PPI Tax Rebate

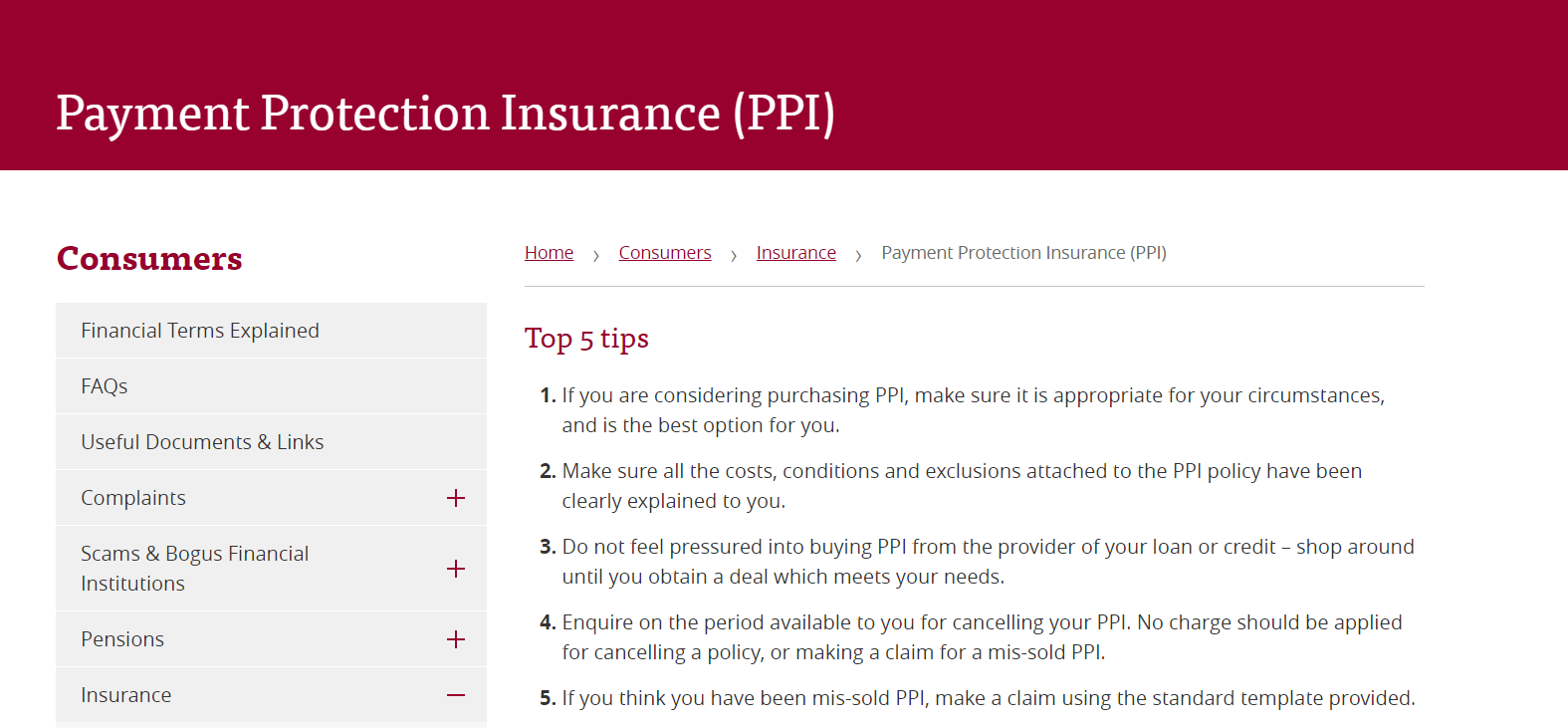

Payment Protection Insurance (PPI) was mis-sold to many individuals in the past, leading to various issues and financial losses. To rectify this, the government introduced the PPI tax rebate. This rebate aims to compensate those who were wrongly sold PPI, ensuring they receive their money back.

Who Can Claim a PPI Tax Rebate?

The eligibility criteria for a PPI tax rebate are quite straightforward. If you have ever been sold PPI without your knowledge or consent, you are eligible to claim a rebate. This applies to anyone who has had loans, credit cards, or mortgages with PPI attached and needs to be fully informed about it.

The Importance of PPI Tax Rebate

Reclaiming a PPI tax rebate is not just about getting your money back; it’s about righting a wrong. It’s about ensuring that financial institutions are held accountable for their actions. Furthermore, it can provide a much-needed financial boost, allowing you to regain control of your finances.

How to Check if You Are Eligible

To find out if you are eligible for a PPI tax rebate, you can start by reviewing your financial history. Look for any instances where you may have taken out a loan, credit card, or mortgage and determine if PPI was added without your knowledge.

The Process of Claiming PPI Tax Rebate

If you’ve confirmed your eligibility, the next step is to initiate the claims process. This involves contacting the relevant financial institution or a claims management company. They will guide you through the necessary steps to file your claim.

Common Mistakes to Avoid

Avoid common mistakes such as insufficient or incorrect information when claiming a PPI tax rebate. Ensure all your documents are in order and provide precise details about your financial history to expedite the process.

The Deadline for Making a Claim

It’s essential to be aware of the deadline for making a PPI tax rebate claim. The government has set a specific cutoff date; failing to submit your claim before that can result in losing your entitlement.

What Documents Do You Need?

To support your PPI tax rebate claim, you will need certain documents, such as loan agreements, credit card statements, or mortgage details, that show PPI was added without your consent.

The Impact of PPI Tax Rebate on Your Finances

Receiving a PPI tax rebate can significantly impact your finances. It can provide a financial cushion, help you clear debts, or invest in your future. Understanding the financial implications is vital.

The Role of a Professional in the Process

While you can file a PPI tax rebate claim on your own, enlisting the help of a professional claims management company can streamline the process and increase your chances of success.

Tips for a Successful PPI Tax Rebate Claim

Here are some tips to enhance your PPI tax rebate claim’s success:

- Keep thorough records

- Seek professional assistance if needed

- Be patient through the process

- Follow up with the claims management company

Conclusion

In conclusion, a PPI tax rebate can be a significant financial opportunity if you were affected by PPI mis-selling. It allows you to reclaim your money and ensures justice is served. Remember to check your eligibility, gather the required documents, and consider seeking professional assistance. Your financial well-being could greatly benefit from this opportunity.