Primary Rebate South Africa – Attention all South Africans! Did you know that by simply submitting your tax information, you become eligible for some incredible rebates? That’s right! The primary tax rebate includes both a medical tax credit and general tax rebates. This is an opportunity not to be missed – claim what you rightfully deserve and save more money in the process!

Medical Tax Credit

Taxpayers under 65 years old can get a medical credit for medical scheme contributions. This rebate replaces the previous deduction. The following monthly rebates are available for contributions to medical schemes starting on March 1, 2021:

- ZAR 332 Taxpayer

- First dependant: ZAR 332.

- Every subsequent dependant: ZAR 224.

The following is how the annual rebate for excess medical scheme contributions or other medical expenses is calculated:

For taxpayers who are above the age of 65, there is a beneficial tax provision in place. If their medical contributions exceed three times the medical scheme contribution credit, they can claim a deduction of 33.3% on those contributions. Additionally, this deduction also applies to all other qualifying medical expenses incurred by seniors. This helps ease the financial burden on older individuals and encourages them to prioritize their health and well-being.

Individuals with disabilities are eligible to receive a generous reimbursement of 33.3% for medical scheme contributions that exceed three times the amount credited for medical scheme fees. Additionally, they can also avail a 33.3% reimbursement on all other medical expenses incurred. This allows taxpayers with disabilities to receive significant financial support towards their healthcare costs, ensuring they can access the necessary treatments and services without facing excessive burdens on their finances.

If you’re under the age of 65 and don’t have a disability, you may be eligible for a tax credit. This credit entitles you to receive 25% of the total amount, which is calculated by multiplying four times the medical plan contribution credit or any medical expenses that exceed 7.5% of your taxable income. It’s a great way to help offset some of your healthcare costs and reduce your overall tax burden.

General Primary Rebate

Taxpayers can take advantage of general tax rebates to save on their overall tax liability. These rebates serve as deductions that can be subtracted from the total amount of tax owed, ultimately lowering your tax bill and putting more money in your pocket. Don’t miss out on these valuable opportunities to keep more of your hard-earned money!

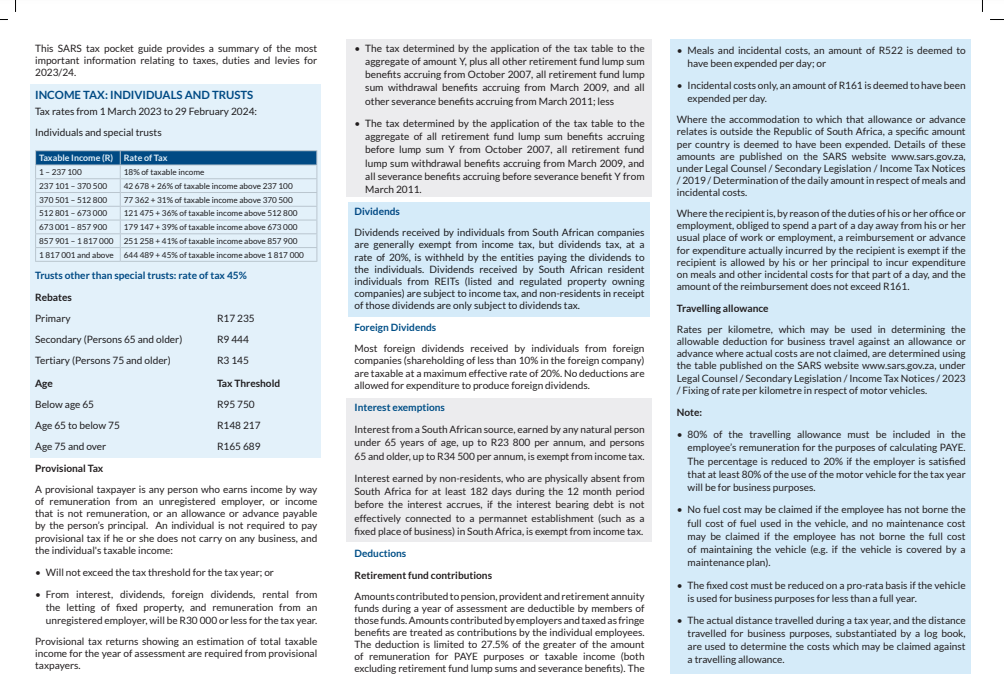

The following rebates are available for the 2024 tax years (i.e. which begins on the 1 March 2021, and ends on the 28 February 2024):

- Primary Tax Rebate: ZAR 15,714 all natural persons

- Secondary Tax rebate: ZAR 8.613 for taxpayers 65 years or older

- Tertiary Tax rebate ZAR 2,871 for taxpayers over 75 years old