PA 2024 Rent Rebate Form – In Pennsylvania, the PA 2024 Rent Rebate Form serves as a crucial means of financial assistance for eligible individuals. This form allows qualifying residents to receive rebates on rent paid during the tax year. Understanding the process of obtaining, completing, and submitting this form is essential for those seeking assistance with housing expenses.

What is the PA 2024 Rent Rebate Program?

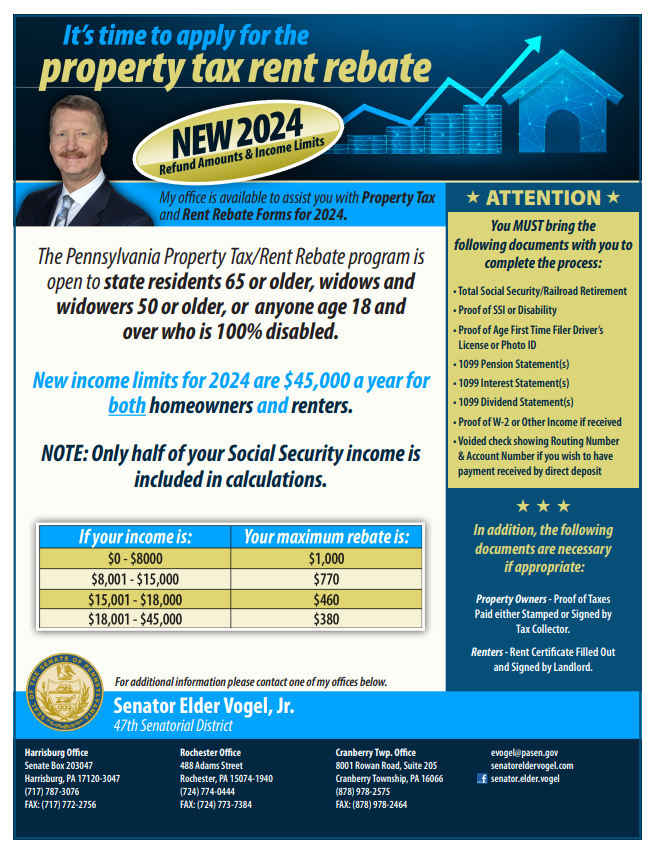

The PA 2024 Rent Rebate Program is a government initiative administered by the Pennsylvania Department of Revenue. It aims to provide financial assistance to individuals who are facing economic challenges, particularly in meeting their rental expenses. The program offers rebates on rent paid to eligible applicants, including low-income individuals, seniors, and individuals with disabilities.

Eligibility for the program is determined based on specific criteria established by the Pennsylvania Department of Revenue. Typically, applicants must meet certain income requirements and fall into one of the eligible categories, such as being a senior citizen, a person with disabilities, or a widow or widower.

The primary purpose of the PA 2024 Rent Rebate Program is to alleviate the financial burden on eligible residents by providing them with financial relief in the form of rent rebates. By doing so, the program aims to help individuals afford their housing costs and improve their overall financial well-being.

How to Obtain the PA 2024 Rent Rebate Form?

To obtain the PA 2024 Rent Rebate Form, you have a few options:

Online Methods:

- Visit the official website of the Pennsylvania Department of Revenue. The form is typically available for download in PDF format, allowing you to print it from your computer.

- Look for specific sections or pages dedicated to the rent rebate program on the website. There, you should find instructions on how to access and download the form.

In-Person Options:

- Visit local government offices or community centers in your area. These places often have physical copies of the PA 2024 Rent Rebate Form available for pickup.

- Inquire at relevant departments within these offices, such as the Department of Revenue or Aging Services, as they may have information on where to obtain the form.

Regardless of the method you choose, make sure to fill out the form accurately and provide all required information and documentation to ensure your application is processed smoothly.

Filling Out the PA 2024 Rent Rebate Form

When filling out the PA 2024 Rent Rebate Form, it’s essential to provide precise details regarding your income, rental expenses, and other pertinent information. Here are some tips to ensure accuracy:

- Gather Necessary Documents: Collect all required documents before starting to fill out the form. This may include income statements (such as pay stubs, Social Security statements, or pension statements), rental receipts or lease agreements, and proof of residency.

- Review Instructions: Carefully read through the instructions provided with the form to understand what information is required and how to fill out each section correctly. Following the instructions closely can help prevent mistakes.

- Double-Check Information: Before submitting the form, double-check all the information you’ve entered to ensure accuracy. Pay attention to details such as numbers, dates, and spelling of names. Mistakes or inaccuracies could lead to delays in processing your application.

- Seek Assistance if Needed: If you’re unsure about how to fill out any part of the form or if you have questions about the information required, don’t hesitate to seek assistance. You can contact the Pennsylvania Department of Revenue or consult with a trusted advisor for guidance.

By taking these steps and being diligent in providing accurate information, you can help ensure that your PA 2024 Rent Rebate Form is completed correctly and processed without delays.

Submitting the Form

Understanding the Rebate Calculation

Understanding how the rent rebate amount is calculated involves consideration of several factors and a standardized process:

Factors Considered

- Applicant’s Income: The income level of the applicant plays a significant role in determining eligibility for the rebate. Generally, lower-income individuals are eligible for higher rebate amounts.

- Rental Expenses: The amount of rent paid by the applicant throughout the year is a key factor in calculating the rebate. Applicants must provide accurate documentation of their rental expenses.

- Deductions and Credits: Certain deductions or credits may be applicable based on the applicant’s circumstances. These can include property tax or utility deductions, as well as credits for seniors or individuals with disabilities.

Calculation Process

- Submission of Information: Applicants submit their income details, rental expenses, and any relevant deductions or credits on the rent rebate form.

- Verification: The Pennsylvania Department of Revenue verifies the information provided by the applicant and ensures compliance with eligibility criteria.

- Calculation: Using a standardized formula, the Department calculates the rebate amount based on the verified information. This calculation considers factors such as income level, rental expenses, and applicable deductions or credits.

- Determination of Rebate Amount: Upon completing the calculation, the Department determines the rebate amount owed to the applicant. This amount is typically issued as a check or direct deposit to the applicant.

By understanding these factors and the calculation process, applicants can gain insight into how their rebate amount is determined and ensure the accuracy of the information provided on their rent rebate form.

Common Mistakes to Avoid

Incorrect Information

Providing inaccurate information on the PA 2024 Rent Rebate Form can lead to delays or even denial of the rebate. It’s essential to verify all details before submission to avoid errors.

Missing Documentation

Failing to include required documentation with the form can also result in processing delays or denial of the rebate. Applicants should ensure that all necessary documents are attached before submitting the form.

Checking the Status of Your Application

Online Portals

The Pennsylvania Department of Revenue often provides online portals where applicants can check the status of their rent rebate applications. These portals offer real-time updates on the progress of the application.

Contacting Authorities

In case of any inquiries or concerns regarding the status of their applications, applicants can contact the Pennsylvania Department of Revenue directly for assistance. Customer service representatives are available to provide support and guidance.

Appealing a Denied Application

Reasons for Denial

If an application for the PA 2024 Rent Rebate Program is denied, applicants will receive notification detailing the reasons for denial. Common reasons include incomplete information, ineligibility, or discrepancies in the provided documentation.

Appeal Process

Individuals have the right to appeal a denied application by following the specified procedures outlined by the Pennsylvania Department of Revenue. This may involve providing additional information or evidence to support their eligibility for the rebate.

PA 2024 Rent Rebate Program Updates

Changes in Eligibility

It’s essential for applicants to stay informed about any updates or changes in eligibility criteria for the PA 2024 Rent Rebate Program. These updates may impact eligibility requirements or the application process.

Updated Procedures

Periodically, the Pennsylvania Department of Revenue may update procedures or requirements for the PA 2024 Rent Rebate Program. Applicants should familiarize themselves with these changes to ensure compliance and avoid any issues during the application process.

Benefits of the PA 2024 Rent Rebate Program

Financial Assistance

The PA 2024 Rent Rebate Program offers valuable financial assistance to eligible individuals, providing them with much-needed support to afford their housing expenses. This assistance can significantly contribute to maintaining stability in their living arrangements.

Support for Low-Income Individuals

The program is particularly beneficial for low-income individuals, seniors, and individuals with disabilities who may face challenges in meeting their housing costs. By offering rebates on rent paid, the program helps alleviate the financial burden on these vulnerable groups, ensuring they have access to safe and affordable housing options.

Conclusion

In conclusion, the PA 2024 Rent Rebate Form serves as a vital resource for individuals in Pennsylvania seeking financial assistance with their housing expenses. By understanding the eligibility criteria, application process, and potential pitfalls, applicants can navigate the process more effectively and secure the assistance they need.