Oklahoma Renters Rebate 2024 – Oklahoma’s renters program will begin in 2024. This program will provide a rebate up to $1,200 for eligible renters with low- or moderate incomes. Renters must earn less than $50,000 annually to be eligible for the rebate. Renters who reside in Oklahoma for six months or more will be eligible to receive the rebate.

How the Oklahoma Renters Rebate Works

Oklahoma Renters Rebate provides a rebate for eligible renters. The amount of rent paid in the previous year is the basis for the rebate and it is limited to $1,200. You must meet the following requirements to be eligible for the rebate:

-Reside in Oklahoma

-Also, you must exist at smallest 18 years aged

-Have an income of not more than $35,000

-Be a U.S. citizen, legal resident

-Do not claim the rebate for another residence

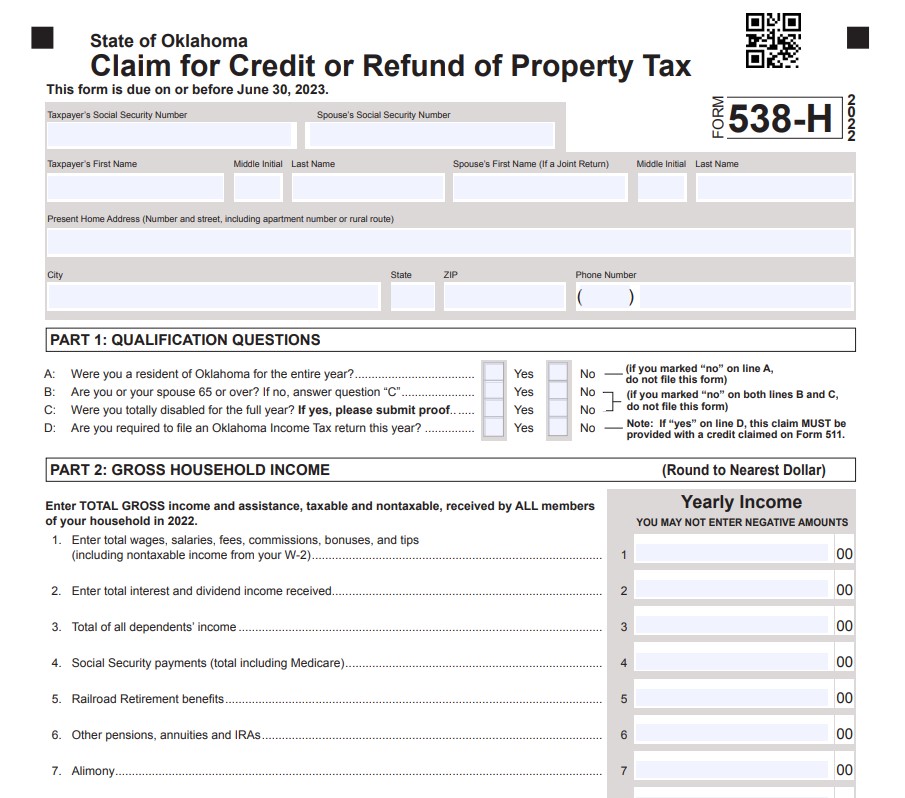

You can apply for the Oklahoma Renters Rebate Claim Form if you meet the eligibility requirements. Deadline to submit the form: April 15th

Who is eligible for the Oklahoma Renters Rebate

Oklahoma renters may be eligible to receive a rebate on their rent. Oklahoma Renters Rebate provides up to $1,200 in rebates to renters who are eligible. You must meet the following requirements to be eligible for this rebate:

Oklahoma residents:

– Must be at least 18 years of age

– You have an annual income less than $50,000

– You have paid rent at least six months in a calendar year

You can apply for the Oklahoma Renters Rebate if you meet the eligibility criteria. To do so, fill out the application and submit it to the Oklahoma Tax Commission. The deadline for applying for the rebate is November 1, 2019.

How to apply for the Oklahoma Renters Rebate

Oklahoma Renters Rebate provides a rebate for renters who have their Oklahoma primary residence rented. The amount of the rebate paid is determined by a percentage. Renters must meet income and residency requirements to be eligible for the rebate.

Eligible renters must fill out and submit a Renter Rebate application to be eligible for the Oklahoma Renters Rebate. The application must be received by the 30th June of the year for which the rebate is to be claimed.

Renters will need information about their household. This includes the names and Social Security numbers for all household members. The renters will need to give information about their rental property including its address, monthly rent amount and contact information. They will also need to show proof of income or residency.

A copy of the most recent federal tax returns, W-2 forms or 1099 forms can be used to prove income. A copy of the current lease receipt or rent receipt can prove residency.

After the application has been completed, you can mail it to the Oklahoma Tax Commission at that address. If the rebate is approved, it will be sent in the form a check. It will be mailed at the address given on the application.

What happens if you miss the deadline to apply for the Oklahoma Renters Rebate

Oklahoma renters may be eligible to receive a rebate on their rent. What happens if you miss a deadline to apply?

You won’t get the rebate if you miss the deadline. The rebate is available only for rents paid within the last calendar year.

You can receive up to $1200 back on your rent if you are eligible for the rebate. It’s based on how much rent you paid and is available to households earning up to $50,000.

You choice must to conduct a condition to apply for the rebate. You can access the form online at the Tax Commission’s website.

You can reach the Tax Commission at (405-521-3160) if you include queries regarding the rebate procedure.

FAQs regarding the Oklahoma Renters Rebate

Are you looking for information about the Oklahoma renters rebate program? These are six commonly asked questions that will help to explain the program and show you how it can be of benefit to you.

1. What is the Oklahoma renter rebate?

Oklahoma renters rebate: This tax credit is available to renters who are eligible and live in Oklahoma. The credit can be equal to a percentage paid rent, but not more than a maximum amount.

2. How can I be eligible for the Oklahoma renters rebate

You must meet these criteria to be eligible for the Oklahoma renters rebate:

You must be a Oklahoma resident.

You must be at least 18 years old.

-You must have rented during the tax year you are applying for the credit.

-Your household income cannot exceed the maximum credit limit.

3. How can I apply for the Oklahoma renter rebate?

You must fill out and submit the Renter’s Rebate Claims Form (Form 511H) to be eligible for the Oklahoma renters rebate. You must post the form by April 15th to be eligible for the Oklahoma renters rebate.

4. What is the Oklahoma renters rebate worth?

Oklahoma renters rebate equals a percentage rent paid up to a maximum amount. Maximum credit for households of two or more people is $1,200, and $600 for households that have one person.

5. What time will the Oklahoma renters rebate be available?

Oklahoma renters will receive a tax rebate. The Oklahoma Tax Commission will send you a rebate check if you are eligible.

6. What is the Oklahoma renter rebate?

Oklahoma renters rebate available for tax years 2018 & 2019. The credit will be phased in over three years, beginning in 2020.

Download Oklahoma Renters Rebate 2024