Rent Rebate Form For 2025 – Rent rebates can provide much-needed financial relief for tenants, especially during challenging times. As we navigate through the year 2025, understanding the process of obtaining a rent rebate form is crucial for individuals seeking assistance. In this article, we’ll delve into the details of rent rebate forms, eligibility criteria, application procedures, and more.

Rent Rebate Form

Tenant Information:

- Full Name: ____________________________

- Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Landlord Information:

- Landlord’s Name: ____________________________

- Landlord’s Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

- Phone Number: ____________________________

Rental Property Information:

- Property Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

- Monthly Rent Amount: ____________________________

- Lease Start Date: ____________________________

- Lease End Date: ____________________________

Reason for Rent Rebate Request:

Please check the appropriate reason for your rent rebate request:

[ ] Loss of Income [ ] Unexpected Expenses [ ] Significant Repairs Needed [ ] Other (Please Specify): ____________________________Supporting Documentation:

Please attach any supporting documentation to validate your rent rebate request. This may include:

- Pay stubs showing loss of income

- Medical bills or receipts for unexpected expenses

- Estimates or invoices for significant repairs

- Any other relevant documentation

Declaration:

I hereby declare that the information provided in this application is true and accurate to the best of my knowledge. I understand that providing false information may result in the denial of my rent rebate request.

Tenant Signature: ____________________________ Date: ____________________________

Submission Instructions:

Please submit this completed form along with all supporting documentation to the appropriate government agency or housing authority. Contact information for submission should be provided by your local authority.

For assistance or inquiries, please contact: [Agency/Housing Authority Name] [Address] [City, State, Zip Code] Phone: ____________________________ Email: ____________________________

Understanding the Purpose of a Rent Rebate Form

The primary aim of a rent rebate form is to alleviate financial strain on tenants by offering them financial assistance towards their rent payments. This assistance is typically directed at low-income individuals or those facing temporary financial challenges.

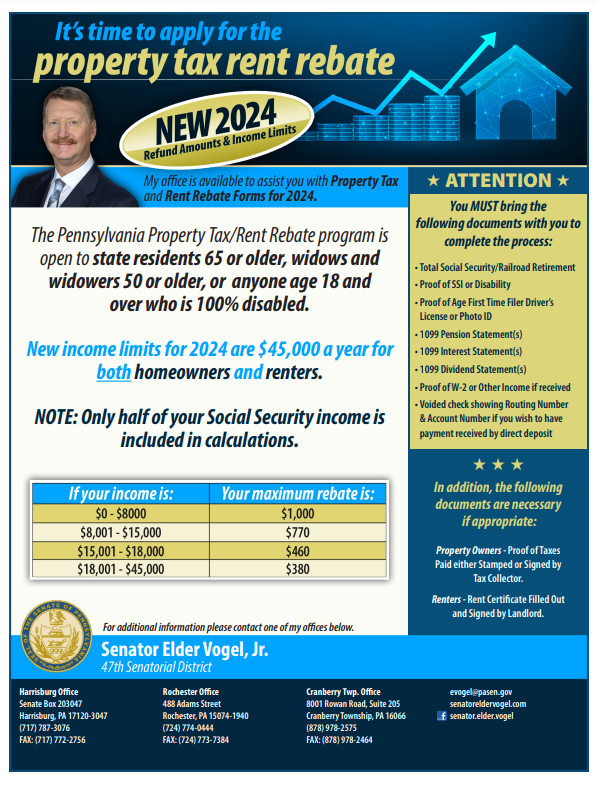

Eligibility Criteria for Rent Rebate

To be eligible for a rent rebate, tenants must meet specific criteria, which can vary based on jurisdiction and program regulations. Common eligibility requirements include:

- Income Limits: Applicants must fall within specified income thresholds to demonstrate financial need. These thresholds are often determined based on household size and local cost of living.

- Residency Status: Generally, applicants must be legal residents of the jurisdiction offering the rent rebate program. Proof of residency may be required, such as a lease agreement or utility bills.

- Financial Need: Applicants must demonstrate a genuine financial need for assistance with rent payments. This may involve providing documentation such as pay stubs, tax returns, or proof of unemployment benefits.

- Other Requirements: Depending on the program, additional criteria such as age, disability status, or household composition may also impact eligibility.

It’s essential for applicants to carefully review the specific eligibility criteria outlined in the rent rebate program guidelines provided by their local government or housing authority. Meeting these criteria increases the likelihood of approval and receipt of financial assistance towards rent payments.

How to Obtain a Rent Rebate Form

Documentation Required for Rent Rebate

When applying for a rent rebate, applicants are typically required to submit various documents to support their application. These may include:

- Proof of Income: Documents such as pay stubs, W-2 forms, or tax returns are commonly requested to verify the applicant’s income level. This helps determine eligibility for the rent rebate based on financial need.

- Lease Agreement: A copy of the lease agreement for the rental property is often required to confirm the terms of the tenancy, including the monthly rent amount and lease duration.

- Utility Bills: Providing recent utility bills can help demonstrate the ongoing expenses associated with maintaining the rental property. This may include bills for electricity, water, gas, or other utilities.

- Proof of Residency: Applicants may need to provide proof of residency, such as a driver’s license, state ID card, or utility bills with their current address, to confirm their eligibility for the rent rebate within the jurisdiction.

- Additional Documentation: Depending on the specific requirements of the rent rebate program, applicants may be asked to submit additional documentation, such as proof of household composition, medical expenses, or other relevant paperwork.

Common Mistakes to Avoid

When completing the rent rebate application and gathering supporting documentation, it’s important to avoid the following common mistakes:

- Incorrect Information: Ensure that all information provided on the application form and accompanying documents is accurate and up-to-date to prevent delays or rejection of the application.

- Missing Documentation: Carefully review the list of required documents and ensure that all necessary paperwork is included with the application to support eligibility for the rent rebate.

- Failure to Meet Eligibility Requirements: Be familiar with the eligibility criteria for the rent rebate program and ensure that you meet all requirements before submitting the application.

Submission Process

Once the rent rebate form is completed and all required documentation is gathered, applicants can submit their application according to the instructions provided by the issuing authority. This may involve mailing the application, submitting it online through a designated portal, or delivering it in person to a specified office or agency. Follow the submission instructions carefully to ensure that the application is received and processed in a timely manner.

Reviewing the Application

After submission, the rent rebate application undergoes a thorough review process to ensure compliance with eligibility criteria and the accuracy of the information provided. Trained staff members or administrators carefully examine each application to assess its validity and determine the applicant’s eligibility for the rent rebate.

- Verification of Eligibility: During the review process, the eligibility criteria outlined by the rent rebate program are closely scrutinized. This includes verifying the applicant’s income level, residency status, household composition, and any other relevant factors that may impact eligibility. Applicants may be contacted for additional information or documentation if needed to clarify or substantiate their eligibility.

- Accuracy of Information: Administrators meticulously review all information provided on the application form and accompanying documents to ensure accuracy and completeness. Any discrepancies or inconsistencies may prompt further investigation or clarification with the applicant.

Timelines and Processing Period

The timelines for processing rent rebate applications can vary depending on various factors, including the volume of applications received, administrative procedures, and available resources. Applicants should be prepared for processing periods that may range from several weeks to several months.

- Communication with Applicants: Throughout the processing period, applicants may receive updates or notifications regarding the status of their application. This may include requests for additional information, notices of approval or denial, or updates on the estimated timeline for processing.

- Patience and Understanding: Applicants are encouraged to exercise patience and understanding during the processing period, as the review process may take some time to complete thoroughly. Delays may occur due to factors beyond the control of the administering authority, and staff members work diligently to process applications as efficiently as possible.

- Follow-Up and Inquiries: If applicants have any questions or concerns regarding the status of their application, they should feel free to follow up with the appropriate government office or housing authority for assistance. Staff members are available to provide support and address inquiries related to the rent rebate application process.

Overall, the review process aims to ensure fairness, accuracy, and transparency in the evaluation of rent rebate applications, ultimately facilitating the distribution of financial assistance to eligible tenants in need.

Receiving the Rent Rebate

Conclusion

Rent rebate forms play a crucial role in assisting tenants facing financial difficulties with their rent payments. By familiarizing themselves with the eligibility criteria, application process, and potential pitfalls to avoid, individuals can navigate the process more efficiently and access the support they require.

Understanding the purpose of rent rebate forms is essential, as they provide a means for tenants to alleviate the financial burden associated with renting. These forms are designed to offer monetary assistance to those who qualify, often targeting low-income individuals or those experiencing temporary financial challenges.

Download Rent Rebate Form For 2025

Frequently Asked Questions (FAQs)

- What is a rent rebate form?

- A rent rebate form is a document that allows tenants to apply for a refund or reduction in rent payments based on specific criteria.

- Who is eligible for a rent rebate?

- Eligibility criteria typically include income limits, residency status, and proof of financial need.

- How can I obtain a rent rebate form?

- Rent rebate forms can be obtained from local government offices, housing authorities, or online portals.

- What documents are needed for a rent rebate application?

- Documents may include proof of income, lease agreements, utility bills, and other relevant paperwork.

- How long does it take to receive the rent rebate?

- Processing times may vary but generally range from several weeks to months depending on administrative procedures and application volume.